Time Is Still On The Buyer’s Side

With mortgage rates still near generational lows, national home prices down more than 20% from the peak and the government providing tax incentives for homebuyers, it seems like a great time to buy a house to many homeowners. The number of multiple offers that buyers have been encountering in every price range in the Westside/South Bay markets would lead one to think they may have missed the boat to buy last year. . .but did they?

According to Zillow chief economist Stan Humphries, those people who can afford to wait to buy a house are probably better off. Based on the most recent data which this blog has been forecasting for months, Humphries notes the official inventory numbers “don’t capture all the foreclosures that are out there” or the so-called shadow inventory of homes waiting to come on the market.

A recent Zillow.com survey shows 8% of homeowners, or about 10 million Americans, are very likely to sell as conditions improve.

Humphries doesn’t expect anywhere near 10 million more homes to come on the market in the near term. But this “pent-up supply” combined with foreclosures already in the pipeline and those yet to come because of negative equity and job losses means it will take three-to-five years “before we see more normal appreciation rates return to the market,” the economist predicts.

“If you’ve got good credit and can put a down payment down…and you’re planning to stay in the house for an extended period of time [like] seven-to-10 years, then now could be an attractive time to buy”

A few other things to consider: The end of the Federal Reserve’s subsidy of the mortgage market interest rates in a few weeks which could push rates up to 5.5% by mid-summer which is right when Foreclosure sales and real estate owned (REO) properties are on track to spike.

Furthermore, real estate prices are not determined simply by the availability of properties listed for sale. The home-buying population’s purchasing power, limited to 31% of a prospective homebuyer’s income, is directly related employment. In California, 2.5 to 3 million people remain jobless.

Given the facts and trends before us, time is still on the buyer’s side.

Bank of America to reduce mortgage principal for some homeowners

The $3-billion program involves borrowers with certain adjustable-rate loans written by Countrywide Financial, which BofA acquired in 2008. Please click on the link below to read the full LA Times article:

Bank of America to reduce mortgage principal for some homeowners

$10,000 Tax Credit For Californians Extended…

California lawmakers have voted to extend a $10,000 tax credit for first-time homebuyers.

The credit will apply to first-time buyers who purchase new or existing homes between May 1 and Dec. 31 of this year. It is for 5 percent of the purchase price, or up to $10,000.

However, this is a first come first serve program. Once the program cumulatively reaches One-Hundred Million Dollars in credits it will be suspended.

Good News for Downtown LA: Evo Condo Tower Moving Units

(*cliff notes version of article in LA Business Journal by Daniel Miller)

After cutting prices by as much as 30% last year, 193 of the South Park building’s 311 units were sold in 2009, making it one of the fastest selling condo buildings in the country.

With the market showing signs of life, the developer South Group, said it has raised prices by as much as 20% from the lows hit last year and sold 15 more in January and February. They are hopeful they will sell the remaining 81 units before the year is out.

The news of the Evo sales is encouraging in the midlevel and high-end condo market which has taken a huge hit over the past few years.

The evidence is not just anecdotal that there has been a pickup in the market.

Condo sales rose last year as developers slashed prices. The trend continued in February, when 1,393 condos were sold in Los Angeles County, nearly 50 percent more than in February 2009. The median price of $295,000 is about where it was a year earlier – well off the $460,000 high hit in mid-2007.

Thanks to condo projects being converted into apartment building and little to no construction, a strong reduction in inventory has helped condo projects recover from the lows of last year.

Evo, at 1155 S. Grand Ave., features a 24th-floor open-air lounge, a sixth-floor pool deck and amenities typically reserved for Wilshire Corridor condo properties, such as concierge and bellman services. Units include terraces, oak floors, exposed concrete walls and stainless steel European appliances.

The original plan called for Evo to be nearly sold-out by the September 2008 opening. The worst case envisioned was that perhaps 20 percent of buyers wouldn’t get approved for loans and those units would be sold later. But the reality was far worse. At one point, about 200 units had been presold, but as the economy cratered, people backed away from the deals, despite deposits and executed contracts. Ultimately, no more than a dozen units were sold to original presale buyers.

30 offers for 11820 Stanwood in Palms/Mar Vista

That’s right, 30 offers were submitted for this 1,467 sq. ft. property situated on a 9,088 sq. ft. lot. The list price of $699K was about $50,000 lower than market value and the tactic of auctioning it off ended up working well with sources close to the situation saying it went to an all cash buyer for $810K!

Will see if it stays in escrow. The charming home is nice but is a remodel candidate and was hugely popular due to the lot size and prime Mar Vista location.

Manhattan Beach Keeping Pace With Strong February Sales

Single family homes sales west of Sepulveda in Manhattan Beach have maintained the strong sales pace set in February with 17 homes going into escrow in the second half of February, and 11 more in the first 15 days of March according to the Multiple Listing Service “MLS”.

17 new listings hit the market in March so new offerings are still outpacing sales but this uptick in activity is showing an upward market trend in the area.

With new offerings, sales, failed escrows, total inventory rose by just 5 listings over the end of February, to 83 SFRs by mid-March. Broken into sections, The Hill Section has 18, Sand Section 34 and the Tree section 31.

The builder’s seem to be getting back into the game in the sand section as homes being sold for land value are beginning to move. 405 9th sold in 6 weeks despite the very high list price of 2.3m (probably sold for less than 2m) and 416 6th listed at 1.799 two weeks ago, quickly went into multiple offers and is in escrow.

sources: Multiple Listing Service/Manhattan Beach Confidential

Jumbo Mortgage Rates Slip Below 6%…(*Edited)

(*edited from original post…)

Interest rates on jumbo loans over $729,750 are down from well above 7% in late 2008 to an average of 5.9% in mid-March, signifying a possible return to lending fundamentals in high-cost areas as jumbo mortgage rates are within 1 percentage point of standard prime loans.

During the height of the market, between 2005 and 2006, jumbo loan interest rates were typically a quarter of a point higher than standard conforming loans. Due to the foreclosure meltdown, the interest rate spread between a standard and a jumbo loan expanded to about 1.7 percentage points in early 2009 as lenders were reluctant to issue high-risk loans.

Down payment requirements have also been relaxed. The average down payment requirement for jumbo loans last year was 25-35%. Some larger lenders are now requiring only 20% on loans under a million.

However, if you are purchasing a property with a loan for over a million dollars, still expect a 25-35% downpayment and two appraisals will be needed. Most purchasers on the high end end up going with Hybrid ARM’s and face heavy scrutiny from the banks. The environment is better for purchasers than it was last year but still a very tough process to get through.

As the Fed begins withdrawing its support of the mortgage loan market this month, rates may creep back up but expect them to stay around the 6% mark for the next few months.

Though the banks are finally working with jumbo borrowers, please keep in mind the delinquency rate for California jumbo loans has shot up from 4.1% to 11.3% in the past year.

The increased delinquency rate for jumbo loans is no surprise. Many expensive homes were bought with adjustable rate mortgages (ARMs) in 2005-2006. The majority of the popular 5-year ARM’s are adjusting upward with the peak between now and 2011.

Benchmark Short-Term Rate To Stay Low For Extended Period

Federal Reserve policymakers left their benchmark short-term interest rate unchanged in the range of zero to 0.25% and once again pledged to keep it low for an “extended period”.

The central bank continued to sound relatively upbeat about the economy, saying the data it looks at suggest that “economic activity has continued to strengthen and that the labor market is stabilizing.”

The Fed also said it would end, on schedule, its program of buying mortgage-backed bonds to help keep home loan rates low. That program will conclude at the end of this month when the Fed’s mortgage bond holdings reach the $1.25-trillion limit it set last year.

Even though the market obviously knows that the end of Fed bond purchases is near, average 30-year mortgage rates have remained around 5% for the last nine weeks.

Chris Rupkey, economist at Bank of Tokyo-Mitsubishi, says some Fed policymakers have suggested that the phrase equates to three to four Fed meetings. If that’s true, “This means the Fed consensus today thinks they will not need to move interest rates until the Sept. 21 meeting,” Rupkey said.

For a second straight meeting, one Fed official dissented in the statement. Thomas Hoenig, president of the Fed’s Kansas City bank, objected to the pledge on low rates.

Hoenig “believed that continuing to express the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted because it could lead to the buildup of financial imbalances and increase risks to longer-run macroeconomic and financial stability,” the Fed said. Summed up, he’s worried about inflation…

*Source: LA Times

Street Beat: North of Montana Brimming With Activity

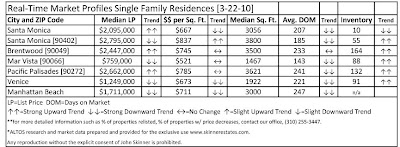

The strong market activity we have seen for the past six months in the market under a million dollars is now happening with homes up to 3 million dollars. The spring selling season is in full effect especially with families looking to get into better school districts.

The highly desirable North of Montana section of Santa Monica, one of the top 10 wealthiest zip codes in the world, had 6 homes hit the market since March 2nd. Four of them are currently in multiple offers…

512 Georgina- LP: $3,100,000 *fixer but great sq. ft. on a 11,500 Lot. It has been on the market for a few days and already have 3 offers…

111 Esparta Way- LP: $6,195,000 *old world charm but the buyer at this price probably remodels. 4,500 sq. ft. on a flat ½ acre lot! Apparently they have received multiple offers.

610 24th Street- LP: $2,695,000 *Clean East Coast traditional that boasts 3,116 sq. ft. on a 8,700 sq. ft. lot. They have received 5 offers in 7 days.

508 10th Street- LP: $2,195,000 *2,400 sq. ft. Spanish in decent condition that needs cosmetic updating. Situated on a 7,500 sq. ft. lot. Have not confirmed but apparently they are also in multiples.

Westside realtors are the busiest we have been in 5 years and most Westside real estate offices have put help wanted signs up on the door to keep up with the amount of buyers looking for property. I didn’t foresee this happening but this is the reality of the current market with the cheap dollar, a lack of inventory and Jumbo rates becoming more competitive.