Real-Time Market Update + Property Taxes Due by April 10th!

Last week’s notes on the market were well received and we are going to keep this going whenever we have good information to pass along during this unprecedented time. Most importantly, we hope you and those close to you are healthy and safe and are able to implement positive ways to stay connected with each other while practicing social distancing.

Property Taxes– Property taxes are still due by April 10th! Get your payment in if you haven’t done so! Due to state law, it cannot be extended and is a hugely important source of local government revenue. However, beginning on April 11, the day after property taxes are due, people unable to pay on time for direct reasons related to COVID-19 may submit a request for penalty cancellation online. The department has set up a special team to process these requests for those who demonstrate they were affected by the outbreak. Please note, this is just to delay the penalty cost but not the actual taxes due. Here is a link to the LA County Property Tax web-site.

Market Update- Overall, March sales volume for Compass in So Cal ended up on par with last year’s numbers. The first 2.5 weeks of March were on pace to be quite a bit stronger than March 2019 but the slowdown in the last 1.5 weeks of the month balanced it out.

However, April closings will be down at least 30% compared to last year and probably closer to 40% as we won’t see very many quick closings in this environment. Unless a deal is all cash, lenders are not guaranteeing anything quicker than a 35 day escrow with 21 day loan contingency and prefer a 45 day escrow.

New listings in our offices are down about 30% compared to last year which is actually better than anticipated with city of Los Angeles barring agents from showing property, despite the state calling real estate agents an “essential” service. We are expecting new inventory to stay very light until we have a definitive light at the end of the tunnel. Thus, May closings will be lighter than April.

Once we see a light at the end of the tunnel, new listing inventory will pick up quite a bit with many people waiting out the pandemic combined with those who have withdrawn their home from the market.

Lending-Most banks are offering 90-day mortgage deferment programs. Apparently the process is fairly easy and efficient with most of the larger banks. You will still be on the hook for the mortgage payment at a later date but just gives you a three month reprieve to focus on other pressing issues in your life and it is not supposed to negatively impact your credit, but definitely confirm with your bank what program is available and the implications as they vary among banks.

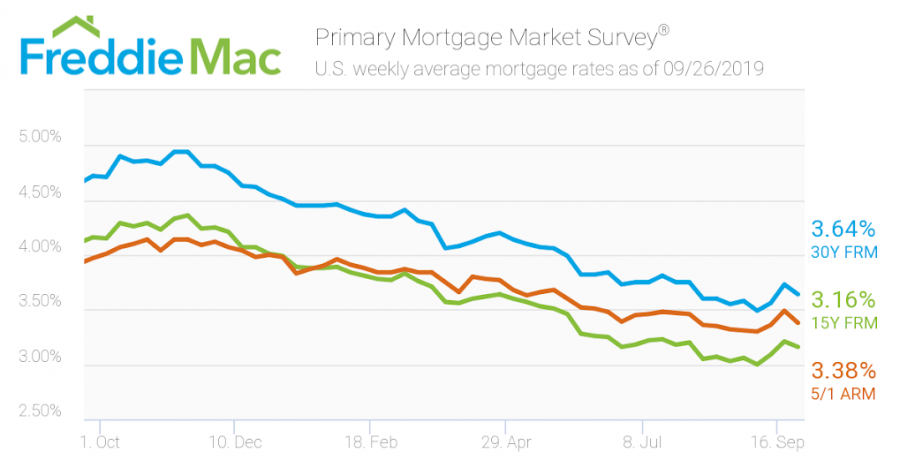

The average U.S. rate for a 30-year fixed mortgage fell to 3.33% this week, according to Freddie Mac, as the Federal Reserve’s bond-buying program created demand for securities backed by home loans. It is a 17-basis point drop from last week. Mortgage applications dropped 24% last week, compared to year earlier. Rates are expected to fall further… More competitive Jumbo rates are being offered by the big banks when it comes to purchases. They are really the only players right now when it comes to jumbo loans.

As I described last week, the re-fi business is still pretty strong and they have enough of a backlog that the rates being offered are not as enticing as one would think…though this could easily change in the next month and something to keep an eye on.

Title- Sampling a few different title companies, new openings this week were off about 40-50% compared to normal levels.

Title companies can close escrows electronically but the grant deed and loan docs are still required to be notarized in person. Escrow companies and the California Association of Realtors are lobbying local country recorder offices to allow notaries to be done electronically by video, but thus far, it has not been considered.

Rental Market After checking in with multiple landlords and property management companies in terms of rent being paid at the first of the month, the average came to about 90% paying on time. They unanimously have concerns about what it will look like next month if things stay status quo.

Here are a few links to information/articles you may find useful-

Los Angeles sees rental prices fall for the first time in a decade

Los Angeles webpage explaining their eviction moratorium

Mortgage lenders are tightening standards as coronavirus crisis worsens