Staging is more important than ever

|

| 1522 Amherst #101 |

One chance is all you have to make a first impression on a buyer, and it needs to happen within the first three weeks of being on the market to maximize a seller’s leverage and sale price. Thanks to major technological advantages allowing consumers to access information within seconds, the time in front of a consumer is continually shrinking. An emotional connection must be made early on!

Despite a slowing market, we attracted multiple offers and sold two condos, 1522 Amherst Avenue #101 and 11687 Montana Avenue #209. They were priced around the true market value and were professionally staged and painted. We cannot emphasize enough how important these steps were in getting the properties sold.

Staging and preparing a house to show in the best light is not cheap but you end up making money on the investment.

Here are some compelling facts from a 2017 study by the National Association of Realtors regarding staging:

|

| 11687 Montana #209 |

* Professional home staging considers the wants and needs of buyers and taps into their psychology when searching for a home.

*81% of buyers say home staging makes it easier to visualize the property as their future home.

*45% of buyers say it will positively impact the value of the home if it is decorated to the buyer’s tastes.

*Among REALTORS® who typically represent the buyer, 49% report most buyers are affected by home staging.

*Once staged, homes spend an average of 73% less time on the market.

*A National Association of Realtors survey found that the longer homes stay on the market, the further their price drops.

*Buyers are willing to spend 1% to 5% more of the dollar value on a staged home than a non-staged home.

Economic Straight Talk- The U.S. Housing Market- Proceed With Caution

California housing markets have shifted since the summer. The question is, “What comes next?” Compass/Pacific Union economist Selma Hepp and John Burns Real Estate Consulting has forecast the next three years.

Online buyer behavior suggests that sales will decline in the West Coast markets with California home sales expected to post a 2% to 7% percent decline over the next six months. Some of the downward pressure can be attributed to interest-rate hikes following strong price growth over the last year which took a large bite out of affordability, making it the biggest concern for California housing markets.

Average annual price growth in six California metropolitan areas is projected at 6% in 2019 and 3% in 2020 before declining by 0.3% in 2021.

Additionally, mortgage rates rose by 88 basis points this year, from 3.95% in January to 4.83% in October, resulting in at least an 11% increase in payments without accounting for price appreciation. Note that each 100-basis-point increase in mortgage rates reduces a borrowers’ purchasing power by about 7%.

With price appreciation, Californians’ monthly mortgage payments are up by as much as 25% year over year: Silicon Valley, up by 25%, San Francisco, up by 19%, The East Bay, up by 17%, and Los Angeles, up by 14%. This reflects the median new home prices, in Los Angeles, the price is $682,000, while in the Northern California, prices range from about $760,000 in Sonoma County to $1 million in Silicon Valley.

Looking forward, mortgage rates will likely reach 5.5 percent by the middle of 2019, leading to fewer home sales. Because of affordability pressure, the LA market is projected to see notably slower price growth over the next three years. Value growth projections over the next three years compared to 2018, which showed a 7.1% rate of growth. That rate is expected to fall to 4.9% in 2019, followed by 3.9% in 2020 and finally a mere 0.8% in 2021.

The bottom line, homebuyers and investors should proceed with caution but proceed nevertheless.

Click below to check out the detailed analysis.

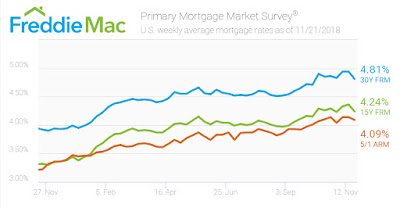

Mortgage rates retreat to lowest level since early October

The 30-year fixed-rate mortgage dropped from 4.94% last week, averaging 4.81% for the week ending Nov. 21, 2018. However, this is still an increase from last year’s rate of 3.92%.

“The downward spiral in oil prices and a volatile equities market caused mortgage rates to decline 13 basis points to 4.81%, the largest weekly drop since January 2015,” Freddie Mac Chief Economist Sam Khater said. “Mortgage rates are the lowest since early October and the dip offers a window of opportunity for would be buyers that have been on the fence waiting for a drop in mortgage rates.”

The 15-year FRM averaged 4.24% this week, down from last week’s 4.36%. This time last year, the 15-year FRM was 3.32%.

Source: Housing Wire

Great Opportunity- 12615 Westminster Avenue- Mar Vista – Reduced to $1.499M OPEN SUNDAY – 1pm-4pm

Reduced from $1.599M, this is a great opportunity to take advantage of the softened Mar Vista market. Situated on a quiet tree-lined street in a highly sought after Mar Vista location, this charming traditional home with great curb appeal sits on an expansive 6,731 sq. ft. lot. The home has been in the same family for over 40+ years and is an entertainer’s paradise with a chef’s kitchen featuring Viking range w/ grill that opens into the living room which flows directly into the indoor/outdoor living concept and expansive backyard with mature landscaping. The large master bedroom with fireplace and custom designed closet captures an abundance of natural light and opens to the backyard via double French doors. A great opportunity to own in an extremely popular neighborhood where you can add-on to the current home or develop a wonderful two-story home with potential view opportunity from the second floor (buyer to verify)

Property Web-Site- 12615 Westminster Avenue

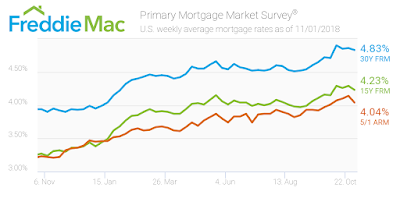

Mortgage rates dip slightly this week

The 30-year fixed-rate mortgage averaged 4.83% for the week ending Nov. 1, 2018, sliding from 4.86% last week, but still much higher than last year’s rate of 3.94%.

“While higher mortgage rates have led to a decline in home sales this year, the weakness has been concentrated in expensive segments versus entry-level and first-time buyer which remains firm throughout most of the rest of the country,” Freddie Mac Chief Economist Sam Khater said.

The 15-year FRM averaged 4.23% this week, moderately decreasing from last week’s 4.29%. This time last year, the 15-year FRM was 3.27%. The 5-year Treasury-indexed hybrid adjustable-rate mortgage moved to 4.04% this week, falling from 4.14% last week. However, this is still higher than this same time last year when it averaged 3.23%.

Realtor.com Chief Economist Danielle Hale said today’s lower mortgage rates are a mixed bag for housing. “Builders are facing the same cost increases as other businesses. This is making it next to impossible to build entry-level homes, which could eventually hold back the homeownership growth rate,” Hale said. “This week’s rate is far higher than what we saw last month and therefore unlikely to entice buyers who have already called it quits.”

Source: Housingwire.com