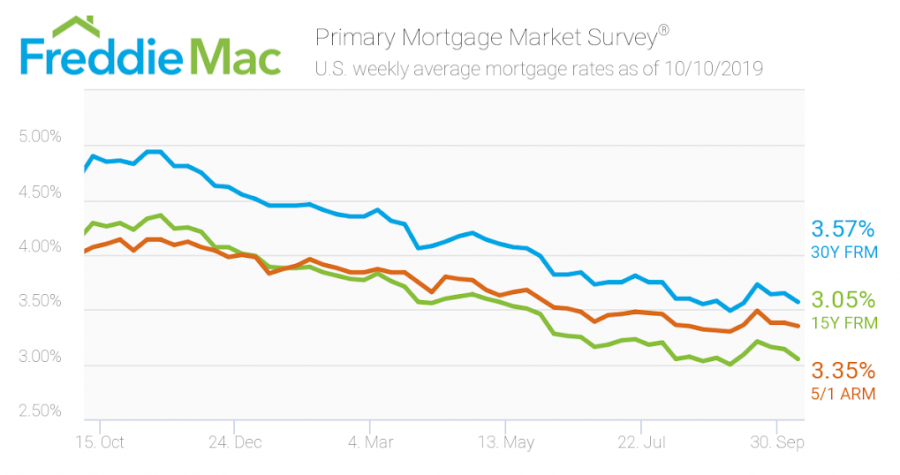

Mortgage rates fall yet again

The 30-year fixed-rate mortgage averaged 3.57% during the week ending Oct. 10, down 8 basis point from the previous week. This is a stark change from a year ago when the 30-year fixed-rate mortgage averaged 4.90%

The 15-year fixed-rate mortgage dipped 9 basis points to an average of 3.05%, according to Freddie Mac. The 5/1 adjustable-rate mortgage averaged 3.35%, down 3 basis points from a week ago.

Mortgage rates roughly track the direction of the 10-year Treasury note, the yield of which has fallen by more than 10 basis points over the last month and roughly 100 basis points throughout 2019. Falling mortgage rates have yet again caused a resurgence in refinancing activity. The most recent mortgage application data from the Mortgage Bankers Association showed that refinance activity was 163% higher than a year ago. The same trend has not occurred when it comes to loans used to buy a home. Purchase loan volume was only up 10% from a year ago, the Mortgage Bankers Association reported.

Source: Marketwatch

Mortgage rates retreat to lowest level since early October

The 30-year fixed-rate mortgage dropped from 4.94% last week, averaging 4.81% for the week ending Nov. 21, 2018. However, this is still an increase from last year’s rate of 3.92%.

“The downward spiral in oil prices and a volatile equities market caused mortgage rates to decline 13 basis points to 4.81%, the largest weekly drop since January 2015,” Freddie Mac Chief Economist Sam Khater said. “Mortgage rates are the lowest since early October and the dip offers a window of opportunity for would be buyers that have been on the fence waiting for a drop in mortgage rates.”

The 15-year FRM averaged 4.24% this week, down from last week’s 4.36%. This time last year, the 15-year FRM was 3.32%.

Source: Housing Wire

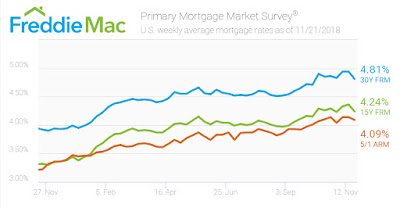

Mortgage rates dip slightly this week

The 30-year fixed-rate mortgage averaged 4.83% for the week ending Nov. 1, 2018, sliding from 4.86% last week, but still much higher than last year’s rate of 3.94%.

“While higher mortgage rates have led to a decline in home sales this year, the weakness has been concentrated in expensive segments versus entry-level and first-time buyer which remains firm throughout most of the rest of the country,” Freddie Mac Chief Economist Sam Khater said.

The 15-year FRM averaged 4.23% this week, moderately decreasing from last week’s 4.29%. This time last year, the 15-year FRM was 3.27%. The 5-year Treasury-indexed hybrid adjustable-rate mortgage moved to 4.04% this week, falling from 4.14% last week. However, this is still higher than this same time last year when it averaged 3.23%.

Realtor.com Chief Economist Danielle Hale said today’s lower mortgage rates are a mixed bag for housing. “Builders are facing the same cost increases as other businesses. This is making it next to impossible to build entry-level homes, which could eventually hold back the homeownership growth rate,” Hale said. “This week’s rate is far higher than what we saw last month and therefore unlikely to entice buyers who have already called it quits.”

Source: Housingwire.com

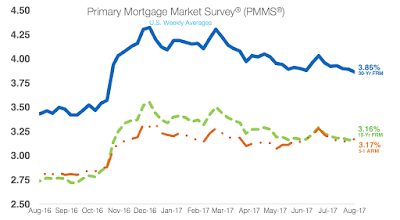

30-year mortgage rates hit a new low for 2017

Mortgage rates decreased for the fourth consecutive week and the 30-year mortgage hit a new low for 2017, according to Freddie Mac’s Primary Mortgage Market Survey.

The 30-year fixed-rate mortgage dropped to 3.86% for the week ending August 24, 2017. This is down from last week’s 3.89% but up from 3.43% last year.

The 15-year FRM held steady at 3.16%, an increase from last year’s 2.74%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased slightly, hitting 3.17%. This is up from 3.16% last week but down from 2.75% last year.

Sources: Freddie Mac and Housing Wire

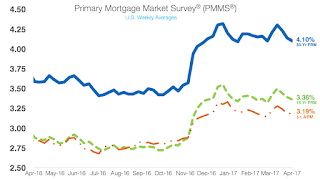

Mortgage rates just above 2017 lows

Mortgage rates dropped for the third consecutive week to just above 2017’s low. The 30-year fixed-rate mortgage dropped to 4.10% for the week ending April 6, 2017.

This is down from last week’s 4.14% but still up from last year’s 3.59%. Similarly, the 15-year FRM also dropped to 3.36%, down from last week’s 3.39% but still up from last year’s 2.88%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased slightly to 3.19%. This is up from last week’s 3.18% and from last year’s 2.82%.

Source: Housing Wire

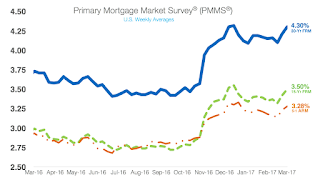

Freddie Mac: Mortgage rates increase again – don’t expect them to stop

Interest rates increased once again in anticipation that the Federal Reserve would increase interest rates Wednesday. “As expected, the FOMC announced its first rate hike of 2017 and hinted at additional increases throughout the remainder of the year,” Freddie Mac Chief Economist Sean Becketti said.

The 30-year fixed-rate mortgage increased to 4.3% for the week ending March 16, 2017. This is up nine basis points from last week’s 4.21% and up from 3.73% last year.

The 30-year fixed-rate mortgage increased to 4.3% for the week ending March 16, 2017. This is up nine basis points from last week’s 4.21% and up from 3.73% last year.

The 15-year FRM increased to 3.5%, up eight basis points from 3.42% last week and from 2.99% last year.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased to 3.28%, up from last week’s 3.23% and last year’s 2.93%.

“Increasing inflation, continued gains in the labor market and the Fed’s intentions for further rate increases—all three will keep pushing mortgage rates up this year,” Becketti said.

Source: Housing Wire

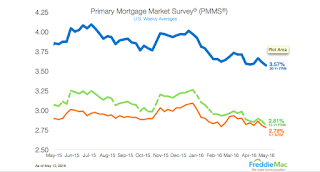

30-year mortgage rates fall to lowest levels in 3 years

Continuing the trend for most of the year, mortgage rates dropped again, falling to their lowest point in three years.

This marks the third consecutive week of declines. “Disappointing April employment data once again kept a lid on Treasury yields, which have struggled to stay above 1.8% since late March. As a result, the 30-year mortgage rate fell 4 basis points to 3.57%, a new low for 2016 and the lowest mark in 3 years,” said Sean Becketti, chief economist with Freddie Mac.

Prospective homebuyers will continue to take advantage of a falling rate environment that has seen mortgage rates drop in 14 of the previous 19 weeks.

|

| Click image to enlarge |

The 30-year fixed-rate mortgage averaged 3.57% for the week ending May 12, 2016, down from last week’s 3.61%. A year ago at this time, the 30-year FRM averaged 3.85%.

Also dropping, the 15-year FRM came in at 2.81%, falling from 2.86% last week. A year ago at this time, the 15-year FRM averaged 3.07%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.78%, decreasing from 2.80% a week ago. A year ago, the 5-year ARM averaged 2.89%. The chart below shows just how low mortgage rates are now.

Source: Housing Wire

Average rate on 30-year mortgage falls

The average rate on a 30-year fixed-rate mortgage declined to 4.04 percent from 4.09 percent a week earlier. The rate on 15-year fixed-rate mortgages slipped to 3.21 percent from 3.25 percent. As in recent weeks, mortgage rates followed the yield on the key 10-year Treasury note, which declined.

Bond yields for Treasury’s were pushed lower by a rise in bond prices.

The average fee for a 30-year mortgage was unchanged from last week at 0.6 point. The fee for a 15-year loan also held steady at 0.6 point.

With mortgage rates at low levels and the economic recovery in its sixth year, home-buying has recently surged as more buyers have flooded into the real estate market. Data issued Wednesday by the National Association of Realtors showed that Americans bought homes in June at the fastest rate in more than eight years, pushing prices to record highs as buyer demand has eclipsed the availability of houses on the market.

Mortgage rates still remain relatively low due primarily to near-zero short-term borrowing rates set by the Federal Reserve, as well as the present lack of investment opportunities for the excess sums in bonds and on deposit with the Fed. This allows homebuyers to borrow more mortgage funds with relatively unchanged incomes. However, mortgage rates will likely begin to increase steadily in late 2015 as the bond market anticipates the Fed’s inevitable short-term rate hike.

The median home price has climbed 6.5 percent nationally over the past 12 months to $236,400, the highest level — unadjusted for inflation — reported by the Realtors.

Sources: LA Times and Housing Wire