Notes on the market and optimizing the sale price of your home

Recently, I have been asked a few questions regarding the market and thought it would be a good idea to gather them up and address them.

Q: How healthy is the housing market? What do you expect the mortgage rates to do in the next year and how will that affect sellers/buyers?

A: The Westside/South Bay markets definitely softened and depreciated some in the 4th quarter, especially when 30 year mortgage rates were around 5% (20% increase year over year) and the stock market was in a correction mode. However, things have picked up quite a bit over the past few weeks with mortgage rates retreating to ten-month lows and wiping out much of the interest rate increase that stalled out the market. Some properties that did not sell in the 4th quarter and were then taken off the market during the holidays and re-introduced after the New Year at the same price point immediately sold with some receiving multiple offers. Overall, we have shifted from the strong seller’s market over the past six years to a more normalized market with a slight lean toward the seller in price points below $5M. This will continue to be the case as long as 30-year mortgage rates stay south of 4.8%. Despite the drop in rates, the ultra-luxury market is typically favoring the buyer with current tax laws (no longer able to write off property taxes) not helping the seller’s cause.

Q: How do the proposed affordable housing guidelines proposed by the new governor look to impact investment in real estate?

A: Housing supply is limited in Southern California. The new affordable housing regulations may take some builders out of new housing development because of the lack of profitability but new homes/condo will still be in demand. New housing starts still significantly lag behind what was being built before the great recession. The supply will not match the overall needs for the job growth on the Westside of Los Angeles. The change in density zoning around the LA Metro route will provide for more housing units, but on the whole, the demand for existing homes will remain high. The one area to keep an eye on in terms of “over-building” is Downtown Los Angeles where developers do not have to battle restrictive building height requirements and this has led to quite a few luxury high-rise projects that will be hitting the market over the next few years.

Q: Where would you spend your dollars when getting ready to sell your house?

A: It is amazing what a fresh coat of paint will do. Consulting with a designer/stager to make the house appeal to a broader audience is also money well spent. Depending on the situation, you may only need to paint, accessorize and de-clutter but a full staging is optimal. With a bigger budget, updating flooring, the kitchen and master bath-room provide the most bang for the buck. Q: How important are open houses to sales? Is it more important to have a well-connected and experienced realtor/agent or great open house, which will get my property sold at the best price in a timely fashion? A: Since over 85% of sales involve a cooperating broker, it is really important to work with an agent that has a great reputation and known within the real estate industry for being positive to work with. The good agents like to avoid those with less than stellar reputations. A great agent will assist in every aspect of creating maximum visibility. Open houses are important to have, especially early on in the process when the property has maximum visibility. The most serious buyers will ask for a private showing if an open house is not available, but most home shoppers usually plan on seeing inventory on Sunday afternoons and over 40% of buyers’ state they first saw the property they purchased at an open house.

Thoughts on the current Westside market and what to expect in 2019

As I stated above, according to various title services, volume is down about 13-15%. We have definitely experienced some market softening with condos at all levels and single family homes above $3M. We have seen a little price depreciation but the softening is more along the lines of a normalizing market. Multiple offers are still common but not as plentiful. The entry and mid-level price points per neighborhood are still appreciating but not at the clip we have seen the past five years.

We are definitely at the end of a summer lull. Some colleagues feel this is a sign for a depreciating 2019 market and when you combine that with lower sales volume throughout the year, they have a point. However, we had a very slow July/August period the past two years and saw things pick up nicely in September and October and frankly, inventory has been dreadful since the beginning of this summer. We have buyers who are ready to go but they have very few properties to choose from.

Silicon Beach is continuing to grow at a very strong pace (ex: Google is in the process of purchasing the Westside Pavilion) providing plenty of high paying jobs; the stock market is still on a bull run and a day does not go by that I do not receive e-mails from agents looking for pocket listings.

Overall, I am expecting things to pick-up again over the next few months (many people are waiting to put their properties on the market after Labor Day weekend). 2019 should be stronger from a volume perspective and most economic forecasts call for a 5% appreciation in home values next year. If interest rates continue to float around the 4.5% mark, I agree with this assessment. However, if rates get to around 5%, I believe we will see a potential decline in values across all price ranges. Mortgage rates will have increased almost 25% in just two years. When you combine that with losing the ability to write-off your property taxes above the standard $10,000 deduction provided, it creates an affordability issue for most buyers.

Thoughts on the future of the Los Angeles housing market

Until this year, the acceleration in housing prices in Los Angeles the past few years was largely driven by investors. We expect the housing market to continue to appreciate over the next 12 months as employment and incomes continue to improve. The Westside and South Bay will continue to see a multiple offer environment with the continued growth of Silicon Beach bringing high paying tech jobs to the area to supplement the already strong demand in a low inventory environment. A potential hiccup would be if the current stock market correction continues a strong downward spiral that would hit the tech sector hard enough that the growth of Silicon Beach is stalled.

|

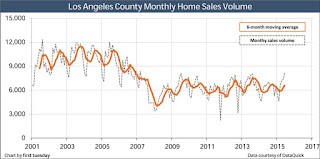

| click to enlarge |

Despite home sales volume rising over last year, we still predict volume to stay low compared to historical standards with people reluctant to give up low interest rate loans and lower property tax base for a more expensive property that is also difficult to find in this market.

Though the outlook looks good in the near future, sine real estate economists feel the impending Fed rate hike will lead to a decrease in home values from late 2016 into 2018. History has shown us that prices naturally fall 9-12 months following a sustainable increase in mortgage rates as the rise in rates will decrease the amount of principal homeowners are able to borrow with the same mortgage payment. This will hit the market at all levels with more of the impact felt on the lower and mid-tier markets. Obviously rates will need to increase for this outlook to take shape and rates have been expected to rise for the past 12-18 months and it has not happened.

|

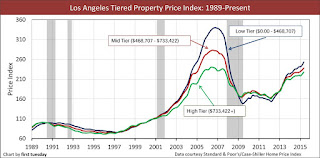

| click to enlarge |

The most sustainable prerequisite to a long-term rise in prices occurs when access to full-time jobs is optimal and according to economists, we will start to see that again in 2018. Once the international markets stabilize, we will see another strong international push to acquire Los Angeles real estate which is also predicted to begin around 2018-2019.

The start of another price appreciation run should be upon us at the end of the decade. In the long run, Westside real estate has proven to be a phenomenal leveraged investment and it will continue to be that way as it is one of most desired places to live in the world. However, prices will depreciate, as we saw from 2007-2009, and as long as you have a long-term outlook and are not constantly borrowing against the equity in your house, it will be one of the best investments you can make.

Average rate on 30-year mortgage falls

The average rate on a 30-year fixed-rate mortgage declined to 4.04 percent from 4.09 percent a week earlier. The rate on 15-year fixed-rate mortgages slipped to 3.21 percent from 3.25 percent. As in recent weeks, mortgage rates followed the yield on the key 10-year Treasury note, which declined.

Bond yields for Treasury’s were pushed lower by a rise in bond prices.

The average fee for a 30-year mortgage was unchanged from last week at 0.6 point. The fee for a 15-year loan also held steady at 0.6 point.

With mortgage rates at low levels and the economic recovery in its sixth year, home-buying has recently surged as more buyers have flooded into the real estate market. Data issued Wednesday by the National Association of Realtors showed that Americans bought homes in June at the fastest rate in more than eight years, pushing prices to record highs as buyer demand has eclipsed the availability of houses on the market.

Mortgage rates still remain relatively low due primarily to near-zero short-term borrowing rates set by the Federal Reserve, as well as the present lack of investment opportunities for the excess sums in bonds and on deposit with the Fed. This allows homebuyers to borrow more mortgage funds with relatively unchanged incomes. However, mortgage rates will likely begin to increase steadily in late 2015 as the bond market anticipates the Fed’s inevitable short-term rate hike.

The median home price has climbed 6.5 percent nationally over the past 12 months to $236,400, the highest level — unadjusted for inflation — reported by the Realtors.

Sources: LA Times and Housing Wire