Skinny’s notes on the market

*Though overall sales numbers were up slightly in the first quarter of 2018 in comparison to last year’s first quarter, we definitely get the sense it was a slow start to the year for most Westside realtors. Things have really picked up in the second quarter but escrow closings are down around 7% compared to last May and inventory is starting to creep up across most price ranges. The majority of buyers are no longer jumping at everything that is on the market and not going after properties unless they feel the pricing is around the true market value. The market is still appreciating and in the seller’s favor with 47% of the listed homes that have sold in LA, selling over the asking price and homes selling at a faster pace than last year, yet the tempo does not feel similar to what we have been used to the past seven years. The one exception to this is the entry point market for zip codes which are still very hot.

*The major Chinese investment in single family housing that we saw between 2012-2016 has definitely died down. (article)— However, that void is being filled by an uptick in Middle Eastern wealth investing on the Westside as well as wealthy Westside families not afraid to purchase multiple homes in upscale neighborhoods either as homes for children or rentals. The explosion of wealth in the tech industry as silicon beach expands, is another key element.

*Based on what we have heard from multiple economists and what we are hearing from our buyers, we expect the Westside market to continue to appreciate at moderate levels through 2019. The new California tax reforms combined with increasing interest rates will start to stall out market momentum once people start feeling the tax hit in April of 2019. Pacific Union believes the market will power through that and not face much resistance till the end of 2020.

*The older single-story home in a great neighborhood might not be the tear-down everyone thinks it is. We have quite a few 60 year-old+ buyers out there that are looking to downsize from their bigger family homes. With amazing weather and all their social connections Los Angeles has to offer, those reaching the golden years want to stay put but prefer a stylish one-level home. The key in development is adding square footage and maximizing a lot’s value but it should be noted that a serious premium will be paid by this type of a buyer for a luxurious one-story in some LA’s priciest locations.

*According to a Redfin Survey, just 6% of Homebuyers would cancel plans to buy if mortgage rates surpassed 5%. 27% say it would cause them to slow the search for a home and 25% said it would have no impact and 21% would increase their urgency in finding a home. This was a national survey of more than 4,000 people. Another key takeaway is that in California, the tax reform and how it impacted taxes was the biggest concern.

* The median rental price for a one-bedroom apartment in the Marina del Rey/Playa Vista neighborhoods, was $2,900 this February, up 15 percent from 2015, according to Zumper.

Inside Dirt- 511 9th Street sells for almost $600K over asking– This 2+2 Spanish Hacienda with detached studio on a 7,500 lot hit the market for $2.895M. The house was a major fixer but has a nice charming feel. The $2.895M list price felt light. The market agreed. They received 16 offers and the vast majority of them were end-users. After a round of counters, it sold for $3.450M with strong rumors of back-up offers near $3.50M. The winner of the multiple apparently did a phenomenal job of standing out as the right buyer for the property in more ways than just price. Presentation matters!!

Skinny’s notes on the market

Welcome back from the August real estate holiday…but don’t let the lull fool you- We saw some multiple offer activity on well price properties in August but it has become apparent over the past few years that activity drops-off enough in August that people wonder if the market is changing…yet, it then picks right back up in Mid-September for a solid six week run before the end of year holiday season. With interest rates at their lowest point for 2017 and a very strong LA economy, we fully anticipate a flurry of activity over the next few months.

Escrow cancellation rates are at all-time lows: In speaking with local escrow officers, cancellation rates are at all-time lows (give or take 10%) compared to rates that were triple that five years ago. A few other observations from the escrow side of things- *shorter escrows (15-21 days) with little to no contingency periods are becoming more frequent. In fact, some are able to still get loans closed within 21 days. We have buyers from San Francisco/Silicon Valley to thank for this trend. In the hyper competitive Bay Area market, all contingencies are being removed upfront on some deals, even on homes that don’t need much renovation.

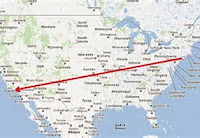

Packing up and moving to the Northwest and Texas?– We are noticing a trend of more people willing to sell and relocate out of So Cal and take advantage of the equity they built in their home. Companies relocating to more reasonably cost real estate is obviously playing a significant role. The popular destinations seem to be the Pacific Northwest and areas around Dallas, Texas.

Moving in…New Yorkers fleeing to Los Angeles: A recent Linkedin report shows New Yorkers are on the move to Los Angeles. We are definitely seeing this trend on the Westside and are currently working with multiple parties from the New York area…Article- New Yorkers fleeing to Los Angeles

Homeless concerns impacting buyers in Venice and Santa Monica?– The homeless issue on the Westside seems to be more noticeable to out of town buyers. We don’t know if the metro has provided easier access to Santa Monica from skid row, but in showing properties in affluent areas (especially Venice and area near the metro in Santa Monica) we are definitely hearing comments on property tours.

Mar Vista/Westchester and Playa Del Rey solidly embraced by Silicon Beach– Mar Vista continues to be very popular with those in the tech world. They love the proximity to Silicon Beach while being central too much of what LA has to offer. It is not as crowded as Venice and with Venice Blvd. and Washington Blvd starting to go through a revitalization with shops and restaurants, we don’t see this trend changing for a long time. The same can be said for Playa Del Rey and Westchester. Both of these areas are also very popular with young families in the tech sector and even though some can afford what would be considered higher-end areas, they are specifically looking to be in these areas.

Caruso development in the Palisades will have an even bigger impact on home values than originally thought– The Palisades has always been at the top of the list of Westside locales of the rich and famous and even moreso with the current re-development of the Palisades village by renowned developer Rick Caruso. However, based on conversations we have had with area developers and real estate professionals, many believe the added value of this development will not truly be felt until it is fully in-use. They expect another step-up in value and demand for the beautiful seas-side area that will now provide amenities and cohesiveness the area did not provide in the past.

27 offers on a condo in Santa Monica with no laundry and heat- Condo with no laundry and heat in Santa Monica garners 27 offers and goes for almost 200K over asking!- When a sharp looking 2+2, 1070 sq. ft. unit located at 609 Washington hit the market for $896K, it definitely garnered a lot of attention but most thought it wouldn’t go crazy due to the unit not having inside laundry and no heating system. Typically, community laundry is a major handicap when it comes to resale value. However, that wasn’t the case this time. The listing agent was overwhelmed with 27 offers. They responded to the top 10 and supposedly sold to for around $1.070M…

SILICON BEACH OPPORTUNITY: 235 OCEAN PARK #C NOW $2.079M- SELLER MOTIVATED!

Now priced under what the market appreciation has been since the owner bought it, this stunning architectural 3 bed 3 bath (over 2,000 sq. ft.) + loft with rooftop deck in the heart of Silicon Beach is just one block from Main Street and 3 blocks from the beach. Take advantage of this great opportunity that was originally listed at $2.349M!

Check out the PROPERTY WEB-SITE and please contact us if you would like to set up a showing.

Most real estate economists and professionals believe Westside/South Bay real estate will continue steady appreciation at least through 2017

The South Bay and Westside real estate markets are continuing to see an influx of buyers and investors despite many highly desirable areas being up over 40% in the past 4 years. A lack of inventory combined with low interest rates, foreign investment and a thriving white collar Los Angeles job market (Silicon Beach) will continue to drive market appreciation. Though we have seen a slight slow-down lately with buyers seeming to be a bit pickier and value conscious (especially above the $2M price point), multiple offers are the norm on properties that are listed at market value.

However, we would see a slow down and lose the positive momentum if the tech industry boom in Los Angeles starts to sputter. Some economic analysts are expressing concern that the tech sector could see a wave of lay-offs in the near future with venture capital funding more difficult to come by in 2016 and young companies not showing the profits that were expected. Despite this possibility looming, most economists that study Westside/South Bay real estate feel the market will stay in the seller’s favor in the foreseeable future and here are the reasons why:

Lack of Inventory– Homeowners are not in a hurry to move. According the California Association of Realtors, first-time homebuyers typically moved to another home within 5 years in the 1980’s and 90’s. Now, the average first-time homebuyers is staying in their property for 8-10 years. Many property owners see value in renovating their current home and keeping the lower property tax as opposed to buying a new home and seeing a dramatic property tax jump. The younger generation of homebuyers also witnessed the housing crisis from 2007-2010 and are a bit gun shy when it comes to pushing affordability on the homeownership front.

Interest Rates- Some economists believe the economy, especially the real estate sector, could not handle much of a jump in interest rates with society acclimating to low interest rates for a prolonged stretch. A jump in rates could paralyze the economy. Those that can afford homeownership are taking advantage of the low rates and with rents continuing to increase at break-neck speeds, the incentive to buy continues to stay strong. Though it is tougher to qualify for a loan, when you do qualify, banks are extremely competitive for the mortgage business. Real estate has proven to be a great long-term leveraged investment and being able to borrow at low rates drives those with money to acquire property. Despite a jump in rates over the past two weeks, rates for a 30 year fixed mortgage are still below where they ended in 2015 (3.64% vs. 3.86%).

Strong Los Angeles job market- With the continued growth of Silicon Beach (i.e.- google constructing a 12-acre campus in Playa Vista), high paying jobs are rolling into the area and unless a tech bubble develops, we don’t see this ending anytime soon. The Los Angeles County Economic Development Corp. released a report showing that the area has more high-tech jobs (368,600) than Boston-Cambridge, Santa Clara County and New York City. The direct high-tech workforce generated over $32 billion in wages back in 2013, accounting for 16.8% of all wages paid in L.A. County, the report said. Silicon Beach has continued to grow at a strong pace over the past two years and Google won’t open its campus for at least another year. The latest report from the LA Economic Development Corporation showed that Los Angeles County should continue to add jobs at a 1.7% annual rate this year and personal income is expected to grow by 4.4%.

Foreign Investment- Overseas investors have had a tremendous impact on the Westside/South Bay markets in the past four years feeling it was safer to put money into American real estate than invest in their own countries. Though the pace of that investing has slowed down over the past six months, it is still happening and will continue with programs like the EB-5 Visa. In its simplest form, the EB-5 visa program enables foreign investors to gain permanent residence status if they invest $1 million dollars in business development or $500,000 in a high un-employment area. Once this investment is made, they usually buy personal residences typically in an all-cash transaction. California is by far the most popular destination for EB-5 investors. The amount of EB-5 applications that are accepted every year is capped around 10,000, with 60,000 applicants awaiting processing. From a global perspective, Los Angeles real estate is considered a good buy when compared to other major cities and will continue to draw strong interest from the Pacific Rim and Canada.