A look at 1Q sales in Mar Vista and Rancho Park/Cheviot (90066 and 90064)

90066 update-

Sales volume was higher in the 1Q of 2017 (73) compared to 62 in the 1Q of 2016. Off-market activity increased with 10 sales compared to last year’s 1Q when 6 sales sold off-market. The majority of the off-market sale activity involved tear-down/land value sales where the seller typically sold the property to a developer which unfortunately for the seller without proper market knowledge or representation, sell it to them for under market. The amount of sales over the asking price remained steady with over 50% of the MLS market sales going for over the asking price (2017=33 vs. 2016=32).

The competition between those vying for a home in Mar Vista is fierce with the area extremely popular with the Silicon Beach crowd and young families priced out of Santa Monica and the Palisades.

Average sale amount/Average price per sq. ft.

2017: $1.463M–$1,083 sq. ft.

2016: $1.347M–$1,026 sq. ft.

Top sale of the quarter- 11927 Tabor Street- The newly constructed 5+6. 4,045 sq. ft. home on a 8,800 lot was listed for $3.395M and they accepted an offer of $3.4M before the first open house. The sale closed on February 14th. It was a beautifully done modern home that is great for entertaining that flows into a spacious backyard featuring a pool. City light views from the master bedroom helped create a strong emotional bond with the buyers. The developer hit a financial home-run with this sale.

90064 update–

It was a strong 1Q with 62 sales recorded compared to just 42 in the 1Q of 2016. The number of homes that sold over asking per the MLS wasn’t as robust as last year (2017= 12 2016= 24) while the off-market activity jumped up to 12 sales compared to just 3 in the 1Q of 2016. It appears that most of the off-market activity involved tear-down lots.

Similar to the sister 90066 zip code, the areas that encompass this zip code are very popular and the demand continues to push sale prices higher, which should be the trend throughout the rest of the year.

Average sale amount/Average price per sq. ft.

2017: $1.896M–$1,104 sq. ft.

2016: $1.214M–$917 sq. ft.

The sale of the quarter- 10974 Ayres Ave- Situated right near the Westside Pavillion and all that Pico Blvd. has to offer, this newly constructed Cape Cod, 5+6, 4,050 sq. ft. on a 6,597 lot created quite the buzz when it hit the market in early January. The $2.495M list price was quickly bid up in a multiple offer situation featuring 5+ buyers and the ultimate sale price was $2.1718M. The sale closed on March 10th. It was a very well-designed home with high-end finishes a great indoor/outdoor flow to take advantage of the So Cal lifestyle.

COOKIE CUTTER FEEL FOR NEW CONSTRUCTION

|

| 12613 Appleton Way (Mar Vista |

We have seen a new construction blitz over the past 24 months and we are expecting it to continue for the next 3 to 5 years. The reality is that many Los Angeles neighborhoods are filled with homes that are close to 80+ years old, and with land values as high as they are we have a strong demand for new/remodeled homes. That said, it would be nice if we could get a little more variation in regards to the interiors and styles that are used by developers. When I am out on Broker Caravan I sometimes wonder if I have seen the same house twice.

|

| 12923 Warren Ave (Mar Vista) |

Mar Vista Community Council “MVCC” Recommends R1V New Zoning to the Department of City Planning and not the Extremely Restrictive R1V2 Proposal.

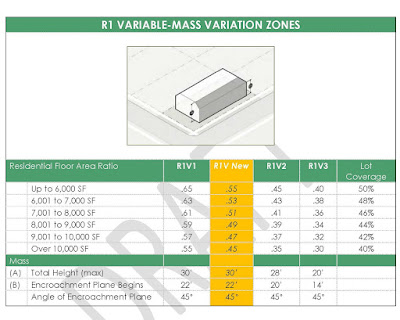

After hearing public comments Wednesday night where the majority of the public speakers were against the City Planning Commission’s proposal for a R1V2 zone change on single-family homes in Mar Vista neighborhoods, the MVCC voted 6 to 2 in favor of recommending R1V New to the City Planning Commission. The new zoning recommendations will replace the existing Interim Control Ordinance “ICO” regarding the Baseline Mansionization Ordinance “BMO” that are set to expire next year. This does not mean the City Council will elect to implement the R1V New zone for Mar Vista but it would be very surprising if they went against the wishes of the Community Council. The R1V2 proposal limits building height and floor area ratio “FAR” significantly compared to the current BMO and would hurt property values. It is an over-reaction to the developers who took advantage of the 20% green building bonus the past seven years and in many cases over-built homes to make more of a profit. The R1V New proposal seems to be a fair compromise which still allows people to remodel and build larger scale homes while curtailing some of the “over-building” by developers. The above chart outlines the options that communities in Los Angeles can choose from. The Department of City Planning will be providing its recommendations to the City Council and people are encouraged to voice their opinions via e-mail to neighborhoodconservation@lacity.org. Here is the link to the full R1 Variation Zone Code Amendment Update as of August 25, 2016

After hearing public comments Wednesday night where the majority of the public speakers were against the City Planning Commission’s proposal for a R1V2 zone change on single-family homes in Mar Vista neighborhoods, the MVCC voted 6 to 2 in favor of recommending R1V New to the City Planning Commission. The new zoning recommendations will replace the existing Interim Control Ordinance “ICO” regarding the Baseline Mansionization Ordinance “BMO” that are set to expire next year. This does not mean the City Council will elect to implement the R1V New zone for Mar Vista but it would be very surprising if they went against the wishes of the Community Council. The R1V2 proposal limits building height and floor area ratio “FAR” significantly compared to the current BMO and would hurt property values. It is an over-reaction to the developers who took advantage of the 20% green building bonus the past seven years and in many cases over-built homes to make more of a profit. The R1V New proposal seems to be a fair compromise which still allows people to remodel and build larger scale homes while curtailing some of the “over-building” by developers. The above chart outlines the options that communities in Los Angeles can choose from. The Department of City Planning will be providing its recommendations to the City Council and people are encouraged to voice their opinions via e-mail to neighborhoodconservation@lacity.org. Here is the link to the full R1 Variation Zone Code Amendment Update as of August 25, 2016

Skinny’s market thoughts as we head into the 4th quarter

The market is jumping all over the place. Certain areas remain hot while others are beginning to see price ceilings develop. Buyers are definitely pickier right now and with more valuation technology, they are strongly in-tune with what a property is worth from a numbers perspective. In many cases they are willing to pay a premium for properties with very few objections, however, the objections are definitely ringing louder if the listing is priced higher than what the market will bear and often attract buyers who are in a mood to negotiate further and press for an even lower price even if the listing has been reduced.

Overall, the market has pumped its breaks a bit with a typical August lull as people were on vacation and getting kids back to school. Last year we experienced a similar August but the market charged forward for the rest of the year. It will be interesting to see how the rest of 2016 plays out. With interest rates still around record lows, we anticipate the market will continue to sway in the seller’s favor.

Hot Spots: Mar Vista up to about $2.4M: The area continues to be very popular with the silicon

beach crowd and young families. On the flip side, despite seeing 8 homes sell for over $3M this year (3 sold for over $3M last year), we are seeing buyers getting hesitant to spend more than $3M unless the property comes with great views or a larger lot. 4056 East Blvd, a 4,000 sq. ft. house on a 8,300 sq.ft. lot originally listed for $3.4M is now reduced to $2.995M despite the house next door, 4060 East Blvd. (4,292 sq. ft. with a nice guest house 4056 doesn’t have) by the same builder selling for $3.350M.

Westchester up to about $1.8M. Kentwood and Loyola Village continue to be wildly popular with young families and Westport Heights, which used to be the red-headed step-child of Kentwood and Loyola Village is seeing its fair share of sales above $1M. 7800 Westlawn in the Kentwood area was listed for $995K, a bit low for a 1,400 sq. ft. house on a 6K lot, received over 7 offers and is rumored to have sold at or close to $1,250,000. Inventory is steadily growing in all price ranges though and we are seeing new construction around $2M sitting for a bit longer…

Pacific Palisades (El Medio Bluffs, Alphabet Streets, Huntington): With the new Caruso development approved and starting construction, areas within a short distance of it are seeing buyers willing to pay a little more of a premium for easy access to this new and exciting development the Palisades has lacked.

Westwood: Westwood’s appealing centralized location along with the wildly popular Westwood Charter Elementary School has created quite the frenzy. 2035 Manning was listed by a colleague at $1.849M and she felt they priced it right around what it would sell for. This 2,100 sq. ft. house on a 6,700 Sq. ft. lot received 17 OFFERS and is in escrow for over $2.1M!!

EXTREMELY IMPORTANT: THE NEW BASELINE MANSIONIZATION PROPOSAL “BMO” AND PROPOSED NEW SING-FAMILY ZONE OPTIONS FEELS LIKE AN OVER-REACTION TO OVERZEALOUS DEVELOPERS AND UNFAIR TO HOME OWNERS…YOU MUST VOICE YOUR OPINION!!

The Planning Department is working on two separate, but related, programs to address concerns about the size of houses in the City’s single-family (R1) neighborhoods: (1) amending the Citywide ordinances (BMO and BHO) that regulate the development of single-family homes, and (2) adopting new single-family zone options that will be applied to neighborhoods currently subject to Interim Control Ordinances (ICOs).

As a resident of Mar Vista, I despise the big, unimaginative cookie-cutter boxes erected all over Los Angeles, especially those with roof-top decks that take away the privacy of neighbors in smaller homes. I hear and agree with these valid complaints and changes need to be made! At the same time, what is currently being proposed, especially for the new single-family zone option for Mar Vista/East Venice and Kentwood (Westchester) is extremely restrictive and irrational.

As a realtor I must disclose that I occasionally work with developers. However, I have NOT been happy with their aggressive push on maxing square footage and using un-imaginative structures to increase profit margins. Unfortunately, this has created the uproar against “McMansions” and the people who are ultimately going to pay the price with highly restrictive square footage rules is the regular homeowner while also de-valuing the land they currently own. Many growing families will not be able to remodel as they intended when they purchased their home under the previous BMO ordinance.

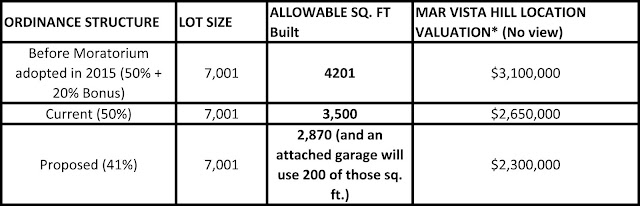

The latest proposal for the Mar Vista/East Venice/Kentwood neighborhoods is extremely restrictive. Until a recent moratorium (ICO), homeowners/developers were allowed to build up to 50% of a lot size with a 20% and sometimes 25% allowable green building bonus. The ICO got rid of the green

building bonus which was a reasonable response to the over-building. However, the loud voices of the anti-mansionization movement have frightened the City Council into making deeper cuts into the size of a house that can be built. The proposed new single-family zones for Mar Vista/East Venice and Kentwood would involve a zone change from R1-1 to R1V2 and would regulate floor area, depending on lot size, to between only 35% and 45%. Currently, if one owns a 7,001 sq. ft. lot in Mar Vista, they can build a 3,500 sq. ft. house. Under the new R1V2 proposal, they would only be able to build up to 41% of the lot size meaning the house can only be 2,870 sq. ft. This is almost a 20% reduction in size and that doesn’t take into account if you have an attached garage where 200 sq. ft. of that would eat into your overall square footage, further reducing your livable square footage to 2,670 sq. ft.!

To give you some perspective on the size of these cuts, see the table below which also takes into account the financial impact this would have on most families largest financial investment. Land value is paramount in Los Angeles and principles will pay less money for land in which less square footage can be built on.

*valuation is based on overall market knowledge and figuring the home is in very good condition. Current land value for a 7,001 sq. ft. lot is around $1.35M+ and will drop overnight if the proposal is passed.

I would also like to address what many homeowners in my neighborhood have expressed to me. They didn’t realize the severity of this proposal and frankly many of them are dual income families with children without the time or energy to show up to the public hearings about this topic.

Attached Garages: Since when would an area in which you park your car be counted against the

livable square footage? It is NOT fair to assume that everyone uses an attached garage as extra living space. Attached garages are essential for safety, especially when a spouse is a frequent business traveler. Attached garages allow for people to build a home that creates a larger backyard which is an essential component for maximizing California living and one’s own land value. I have yet to hear a rationale argument as to why an attached garage should be counted against the allowable floor area of a lot especially when non-attached garage square footage is considered exempt.

Caring for elderly parents/grandparents: People are living much longer. Even though society is having less kids then they did 20+ years ago, the size of families living together is INCREASING. Due to medical and health advancements, some households will have four living generations in them. “By 2025, as many as 25% of the U.S. population will be in multi-generational households and the demand for a different kind of residential property will accelerate over the next decade to meet this demand” (Strategic Advantage Real Estate newsletter). When you combine this with astronomically high rents forcing children to live at home longer than ever, does it really make sense to further restrict a homeowner in regards to what they can do with their property? Also, as a father and someone who grew up with five siblings, I have a serious problem with many of the proponents for the new proposal arbitrarily telling people they can make due in smaller houses. They don’t know the specific needs of a certain families that might require more space, etc. We all have different needs and that should be respected.

Why make the ugly boxes even more valuable?: By passing the proposed ordinance, it will have the unfortunate impact of making those unsightly/over-built shoe boxes even more valuable. They will never be torn down since the homeowner would have to build a significantly smaller house. Since these homes will not have any competition, their value will end up trading at premium prices…so the people with the homes that everyone loves to hate will be in an even better financial position.

Can we just meet in the middle? We need changes but they don’t need to be this dramatic. Why not a proposal that targets the problem areas, but is not an arbitrary reduction in allowable square feet, such as the following proposal:

*A 50% floor area ratio without any bonuses. The 45% proposed in the recent BMO is also too restrictive.

*Create a second floor ratio or an architectural requirement that takes away the boxy nature of larger homes. *Attached garages should NOT be counted against the floor area ratio.

*Roof-Top decks would not be allowed unless explicitly approved by neighbors that would be impacted.

FYI: Pacific Palisades residents have loudly voiced their opposition to this and those outside of the Coastal Zone will have an allowable floor area between 55% to 65%.

LET YOUR VOICE BE HEARD (written submissions are encouraged!):

Contact: Christine Saponara, Department of City Planning-

christine@saponara.lacity.org

Phyllis Nathanson, Department of City Planning- Phyllis.Nathanson@lacity.org/ phone: 213.978.1474

FILL OUT THE ZONING INPUT FORM: Provide your address and e-mail and answer three questions. Shouldn’t take more than two minutes unless you add extensive comments.

For more information check out the Neighborhood Conservation Update web-page.

PUBLIC HEARING INFORMATION

Mar Vista/ East Venice, Kentwood and Pacific Palisades

When: Tuesday, September 13, 2016

Time: Open House at 5:30 p.m., Presentation at 6:30 p.m., Public Hearing at 6:30 p.m.

Where: Henry Medina Building, 11214 Exposition Blvd. Los Angeles, CA 90064

Lower Council District 5, Inner Council District 5, Beverlywood and Fairfax

When: Tuesday, September 20, 2016

Time: Open House at 5:30 p.m., Presentation at 6:30 p.m., Public Hearing at 6:30 p.m.

Where: Henry Medina Building, 11214 Exposition Blvd. Los Angeles, CA 90064

Most real estate economists and professionals believe Westside/South Bay real estate will continue steady appreciation at least through 2017

The South Bay and Westside real estate markets are continuing to see an influx of buyers and investors despite many highly desirable areas being up over 40% in the past 4 years. A lack of inventory combined with low interest rates, foreign investment and a thriving white collar Los Angeles job market (Silicon Beach) will continue to drive market appreciation. Though we have seen a slight slow-down lately with buyers seeming to be a bit pickier and value conscious (especially above the $2M price point), multiple offers are the norm on properties that are listed at market value.

However, we would see a slow down and lose the positive momentum if the tech industry boom in Los Angeles starts to sputter. Some economic analysts are expressing concern that the tech sector could see a wave of lay-offs in the near future with venture capital funding more difficult to come by in 2016 and young companies not showing the profits that were expected. Despite this possibility looming, most economists that study Westside/South Bay real estate feel the market will stay in the seller’s favor in the foreseeable future and here are the reasons why:

Lack of Inventory– Homeowners are not in a hurry to move. According the California Association of Realtors, first-time homebuyers typically moved to another home within 5 years in the 1980’s and 90’s. Now, the average first-time homebuyers is staying in their property for 8-10 years. Many property owners see value in renovating their current home and keeping the lower property tax as opposed to buying a new home and seeing a dramatic property tax jump. The younger generation of homebuyers also witnessed the housing crisis from 2007-2010 and are a bit gun shy when it comes to pushing affordability on the homeownership front.

Interest Rates- Some economists believe the economy, especially the real estate sector, could not handle much of a jump in interest rates with society acclimating to low interest rates for a prolonged stretch. A jump in rates could paralyze the economy. Those that can afford homeownership are taking advantage of the low rates and with rents continuing to increase at break-neck speeds, the incentive to buy continues to stay strong. Though it is tougher to qualify for a loan, when you do qualify, banks are extremely competitive for the mortgage business. Real estate has proven to be a great long-term leveraged investment and being able to borrow at low rates drives those with money to acquire property. Despite a jump in rates over the past two weeks, rates for a 30 year fixed mortgage are still below where they ended in 2015 (3.64% vs. 3.86%).

Strong Los Angeles job market- With the continued growth of Silicon Beach (i.e.- google constructing a 12-acre campus in Playa Vista), high paying jobs are rolling into the area and unless a tech bubble develops, we don’t see this ending anytime soon. The Los Angeles County Economic Development Corp. released a report showing that the area has more high-tech jobs (368,600) than Boston-Cambridge, Santa Clara County and New York City. The direct high-tech workforce generated over $32 billion in wages back in 2013, accounting for 16.8% of all wages paid in L.A. County, the report said. Silicon Beach has continued to grow at a strong pace over the past two years and Google won’t open its campus for at least another year. The latest report from the LA Economic Development Corporation showed that Los Angeles County should continue to add jobs at a 1.7% annual rate this year and personal income is expected to grow by 4.4%.

Foreign Investment- Overseas investors have had a tremendous impact on the Westside/South Bay markets in the past four years feeling it was safer to put money into American real estate than invest in their own countries. Though the pace of that investing has slowed down over the past six months, it is still happening and will continue with programs like the EB-5 Visa. In its simplest form, the EB-5 visa program enables foreign investors to gain permanent residence status if they invest $1 million dollars in business development or $500,000 in a high un-employment area. Once this investment is made, they usually buy personal residences typically in an all-cash transaction. California is by far the most popular destination for EB-5 investors. The amount of EB-5 applications that are accepted every year is capped around 10,000, with 60,000 applicants awaiting processing. From a global perspective, Los Angeles real estate is considered a good buy when compared to other major cities and will continue to draw strong interest from the Pacific Rim and Canada.

Notes on a Realtors Scorecard- A look at high-end sales; will the recent stock market dip impact the housing market; short-term rentals; Developers going crazy in Venice and Mar Vista and more!

High-End sales (above $5M) still tracking to have a strong year: We have heard some concerns

|

| 384 Delfern Drive |

from people who own high-end homes that it feels like the market is slowing down in their neck of the woods. After looking at Multiple Listing Service “MLS” data regarding sales in high-end Westside neighborhoods, we found the market for homes above $5 Million is still doing well. We looked at overall sales from March/April compared to July/August and found the total # of sales was similar with 54 in March/April and55 in June/July. The average days on market dropped to 87 from 100 with properties selling for 96.5% of the list price in July/August compared to 94.65% in March/April. The average sale price dropped to $8.2M from $9.53M but that is partially skewed due to two sales above $45M in March/April headlined by 384 Delfern Drive in Holmby Hills selling for $59.355M (asking price was $75M). The highest sale in July/August was 609 East Channel Road in Santa Monica Canyon selling for $23M (asking price was 27.5M). With the recent stock market turmoil and the strength of the dollar potentially discouraging international bargain shoppers, it will be interesting to see if these numbers continue to hold steady.

Will the recent stock market dip actually help the real estate market?: The dip in the stock market will hurt potential buyers in terms of overall net worth and possibly detour the number of international buyers we have seen, however, many local economists remain bullish when it comes to the short-term future of Southern California real estate. Another factor that will help those looking to purchase a home is the interest rates have been dropping as the stock market drops allowing for the consumer to have more purchasing power. The FED to delay raising the benchmark rate, since some fear a hike in interest rates could push the American economy back into a recession. Here is an article from the LA Times to check out: Real Estate and recent Stock Market turmoil

Short Term rentals take 11 units off the LA rental market everyday: A report released earlier this year from the Los Angeles Alliance for a New Economy showed that short-term rentals are taking good apartments and homes off the regular market they can be rented out at huge mark-ups on sites like Airbnb. Rentals prices have spiked over 20% in the 2.5 years with the average person paying half of their income toward rent (typically you want your rent to be no more than 35% of your income). Curbed LA writer Adrian Kudler wrote an extensive article on the situation.

Developers going crazy in Venice: When you combine Abbott Kinney being considered one of the

sexiest streets in America, Silicon Beach becoming a major player in the LA economy attracting highly paid tech executives, you get developers salivating for properties in the area. 1519 Louella, a 850 sq. ft. home on a 5,900 sq. ft. lot sold for $1.4M on August 1st to a developer in an all-cash transaction. The house was in decent shape and had a pool but word is it will be torn down. To give you an idea on how much property values have jumped, we sold 1509 Louella, similar in sq. ft, lot size and interior, for $942K in May of 2013.

Small house in Mar Vista bordering SM Airport is in escrow for over $1.150M: 12701 Dewey

Street, a 3+1, 1,092 sq. ft. home on a 5,591 sq. ft. lot was listed a few weeks ago for $1,050M and promptly received 8 offers and is currently in escrow for $100K+ over the asking price. Over $1,000 a square foot! Dewey is a nice street but it does border the Santa Monica Airport. On two separate occasions, this house was listed in 2011 and 2012 for $715K and then for $750K and they couldn’t sell it. This is a rare occasion where they are extremely happy it didn’t sell three years ago.

The Eastside is hot as well…20 offers for a 2 bedroom home in Silver Lake/Echo Park: I had a well-qualified client make a strong over-asking offer on 1742 Kent Street which is perched above Echo Park Lake. This 2+3 1930’s Spanish with an UN-permitted artist studio converted from of the three garage stalls, is in great conditions with a beautiful city view from the living room. The house was listed for $849K and received over 20 offers! The emotional appeal of the home kept buyers from focusing on the less than aesthetically pleasing adjacent homes and immediate area it is situated in. It is currently in escrow for over $1M! It sold in the same condition in May of 2013 for $735K.

well-qualified client make a strong over-asking offer on 1742 Kent Street which is perched above Echo Park Lake. This 2+3 1930’s Spanish with an UN-permitted artist studio converted from of the three garage stalls, is in great conditions with a beautiful city view from the living room. The house was listed for $849K and received over 20 offers! The emotional appeal of the home kept buyers from focusing on the less than aesthetically pleasing adjacent homes and immediate area it is situated in. It is currently in escrow for over $1M! It sold in the same condition in May of 2013 for $735K.