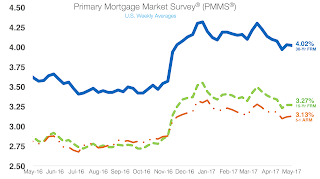

Rates hover near 4% mark

|

| click to enlarge |

Mortgage rates ticked up slightly, but hovered near the 4% mark after the weak gross domestic product increase and the Federal Open Market Committee’s decision not to raise rates.

The 30-year fixed rate mortgage edged down slightly to 4.02% for the week ending May 4, 2017. This is down from last week’s4.03% but still up from last year’s 3.61%.

The 15-year FRM held steady at 3.27%, an increase from last year’s 2.86%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased slightly, hitting 3.13%. This is up from last week’s 3.12%, but down from 2.8% last year.

Source: Housing Wire

Mid-October Update: Mortgage Rates Increase Slightly

Freddie Mac said in its latest survey that fixed rates on home loans increased this week after declining for the past 3 consecutive weeks. For well-qualified borrowers who paid 0.8% of the loan amount in upfront lender fees and discount points, 30-year fixed rate mortgages were offered at an average of 4.21%, up from 4.19% the previous week.

Full Article from the LA Times Money and Company Blog: Mortgage rates edge higher after 3 weeks of declines

Mortgage Rates Drop to 1951 Levels

The LA Times: Money & Company Blog is reporting that mortgage rates have continued their decline to record lows according to Freddie Mac’s survey of lender offering rates.

The 30-year fixed-rate loan dropped to an average of 4.19% this week from 4.27% in the previous week.

Link to the full article: Freddie Mac: Mortgage rates drop again, now at 1951 levels

Mortgage Rates Still Near Record Lows

Freddie Mac said mortgage rates were unchanged this week, while another rate survey set new record lows.

The Freddie Mac weekly survey put the average for a 30-year fixed-rate mortgage at 4.37% with an average 0.7 point for the week ending Sept. 23, stable from last week’s slight increase. A year ago, the average rate was 5.04%.

Freddie said the 15-year FRM average also remain unchanged this week at 3.82% with an average 0.7 point — below last year’s average rate of 4.46%.

The weekly Bankrate survey of large banks and thrifts shows the average 30-year FRM at 4.5% with a 0.35 point, setting a new low in the 25-year-old survey and below 5.36% a year ago. The 15-year FRM was 3.96% with a 0.35 point, down from 4% last week and also at a record low. The 30-year, jumbo FRM averaged 5.17% last week with a 0.35 point, down from 5.19% last week.

*Source: Housing Wire: Mortgage surveys vary slightly, but weekly rates still at or near record lows

Rates come back down after spiking 75 basis points

Rates had been skyrocketing the past few weeks (rising about 75 basis points) but the bond market has been sending slightly better news to mortgage borrowers as investors in securities carved out of home loans have been accepting lower returns. Yields on Freddie Mac and Fannie Mae mortgage securities fell last week meaning the buyers are OK with lower rates on the loans backing the securities.

The typical rate on a fixed-rate 30-year loan rose to 5.59% last week, up from a record low of 4.78% in late April, according to Freddie Mac. Yields on Fannie Mae 30-year fixed-rate mortgage bonds dropped to 4.71%, down from 5.07% last Wednesday and the lowest since June 3. Rising rates have throttled the home refinancing spree that took hold last fall and continued through the winter. While rates under 6% are still great by historic standards, the recent increase also made it tougher to qualify for home purchases, and higher rates generally can put the brakes on the economy