Pacific Palisades Update- House on Las Lomas lists at $1.375M and sells for $1.750M

The Palisades had 27 single family sales in the month of September which beat out last year’s sales for the month by one according to MLS statistics (this does not include off-market activity). Of the 27 sales, 37% (10) sold for above the original asking price. The median sale price was $2.590M and the average days on market was 59 with the sale price coming in at 99.68% of the list price. Let’s take a quick look at a few sales:

Craziest Sale of the Month- 646 Las Lomas- Tear-down on a 8,698 sq. ft. lot: Listed at $1,375M and sold for $375K over asking at $1.750M. The minute this extra-large lot hit the market it created quite a stir with builders and principles looking to build a dream home. An out of area realtor represented the seller and the original list price is evidence of that. The property had over 20 offers with the listing agent ending up representing both sides and angering quite a few local agents and principles. The accepted offer is rumored to have no contingencies and it closed within three weeks. The buyer was probably a builder/contractor with institutional money behind them. The Palisades has been a hotbed of builder activity the past 18 months.

Highlands isn’t just hot from a temperature standpoint- 16617 Calle Brittany, a 5 bed/5 bath, 4,583 sq. ft.on a 7,678 sq. ft. lot had a list price of $1.875M and sold for $1.950M in multiple offers. The house went into escrow in late June and had what appears to be a three month escrow on top of of a leaseback thru October 31st. The Mediterranean style home features a cook’s kitchen, 4 car garage, ocean/mountain vistas and a lush backyard.

Highlands isn’t just hot from a temperature standpoint- 16617 Calle Brittany, a 5 bed/5 bath, 4,583 sq. ft.on a 7,678 sq. ft. lot had a list price of $1.875M and sold for $1.950M in multiple offers. The house went into escrow in late June and had what appears to be a three month escrow on top of of a leaseback thru October 31st. The Mediterranean style home features a cook’s kitchen, 4 car garage, ocean/mountain vistas and a lush backyard.

17211 Avenida De La Herradura- This 4 bed/3 bath, 3,083 sq. ft. home on a 7,921 sq. ft. lot situated at the end of a cul de sac created quite a buzz when it hit the market with a $1.585M list price. The sophisticated and upgraded family home made its debut on a Tuesday broker caravan and immediately drew over a half a dozen offers over the list price and it didn’t even make it to the first Sunday public open house. The final sale price was $1.775M, almost $200K over the original asking price. The house was bought in 2010 for $1.450M and the seller put in another 100K+ of additional upgrades. We represented the buyer.

The odyssey of 1239 Las Pulgas – At first glance you would think people would want to live here for a long time. Completely remodeled down to the studs in 2007, this 4 bed/3.5 bath, 3,600 sq. ft. contemporary home with panoramic views goes through homeowners like most celebrities go through marriages. From a realtor’s perspective it provides the perfect example that sale prices in the area have surpassed those in 2007. The house was sold in 2008 for $3.2M and then sold in 2012 for $2.650M. Eight months later it was back on the market and sold in February of this year for $3.1M before being sold again this September for $3.315M, $165K over the asking price. Despite the rapid turnover the home is still attracting buyers at higher prices so the inspections are checking out well.

Santa Monica Update- only 18 sales in September

Want to put 10% down on a loan? It is available

We just closed a deal in the Palisades in which the buyer put only 10% down for an interest only loan. The deal closed in thirty days with a very competitive interest rate and the process was very smooth. The deal is offered through a wealth management bank but the buyer is not required to place assets with them. They offer 10% down with all of their products if you are not an interest only fan. You must have a FICO score of 760 to qualify. If you are interested in learning more about this feel free to contact me at john.skinner@thepartnerstrust.com.

Interest Rate Chart Since 2008 and some thoughts on the future

Without the major drop in interest rates where would the real estate market be today? We definitely would not have seen the amazing housing comeback of the past two years. What will happen when rates eventually get back to 6 or 7%…will we see another drop in prices or will the economy be strong enough to handle it? One major concern is that while housing values are rising post-great recession, most people in the workforce are not seeing increases in pay and/or working frantic hours to make what they need. Also, the super wealthy are now the strongest they have ever been while the masses struggle. Some of these issues will not impact the westside nearly as much as other areas but I do think we may reach a point in the next few years where housing values may dip a little and stay flat for a very long time.

On the other hand, I cautiously say that as inventory numbers will continue to stay tight on the Westside thanks to Proposition 13 and many homeowners being locked in at historically low interest rates it will make it difficult to find an upleg property that is affordable.

Many Westside retirees have either paid off their home or owe very little and have no incentive to move out of the area since prop 13 protects their tax basis. They do have an exemption over the age of 55 to move and keep the tax basis, but it is tough to leave Westside living.

The Westside is land locked and with tight inventory you would think prices will constantly rise. However, with higher interest rates looming and the overall economy being held together by a string it may not work out that way…ahhh, if only I had a crystal ball.

The Success of Partners Trust

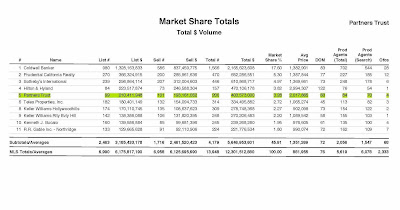

Despite only having 84 producing agents located in four Southern California offices (Brentwood, Santa Monica (2) and Pasadena), Partners Trust ranked 5th in total market share in Southern California through the first half of 2013.

Partners Trust is on track to close over $2.1 billion in sales this year and was named by the Los Angeles Business Journal as one of the top ten places to work in Los Angeles…for the fourth year in a row! The company currently ranks second in average days on market and average price sold.

It is very exciting to be a partner at such a thriving and empowering company. My team is having one of our most productive year’s ever and appreciate having such a wonderful group of clients and referral sources.

*Click on image to enlarge

Mortgage rates level off, 30-year loan averages 4.23%

Mortgage interest rates have leveled off at their lowest levels since June, with 30-year fixed-rate loans averaging 4.23%.

The average rate for solid borrowers with a 15-year fixed mortgage is 3.31%.Freddie Mac pegged the 30-year average at 3.35% in early May. It shot up to 4.58% in August on widespread belief the Federal Reserve would taper off its efforts to keep interest rates low, then fell again when the Fed decided in September that the economy wasn’t strong enough for it to do so.

Borrowers would have paid lenders an average of 0.7% of the loan amount in fees and discount points to obtain the rate, according to the latest report, issued Thursday morning. Appraisal costs and other third-party charges that borrowers often pay are not figured into the survey.

(Source: LA Times)

Articles you should read

LA Times: Southern California housing market slows after torrid rebound

For the third straight month, the median home price across the Southland stayed essentially flat, at $382,000. The September data confirmed expert predictions that waning demand would throw a wet blanket over the white-hot market.

Link to article: Southern California housing market slows

LA Times: Realtors group expects more homes to go on the market, moderating prices

California home sales will increase next year and price gains will moderate as an inventory crunch loosens with more homes on the market, according to an industry forecast.

The California Assn. of Realtors forecasts sales to climb 3.2% in 2014, after falling 2.1% this year amid tight inventory that has helped drive prices rapidly higher.

Link to Article: Realtors group expects more homes to go on market

LA Times: Wealthy Californians have recovered from the recession

About two-thirds of Californians with assets of $1 million or more actually feel better off now than before the 2008 financial crisis, a report from BMO Private Bank said. And roughly the same portion, say they expect the economy to continue its recovery in the next year.

Link to Article: Wealthy Californians have recovered from the recession

New Home Sales Climb in August

Sales of newly built homes climbed 7.9% from July to a seasonally adjusted annual rate of 421,000, the Commerce Department said Wednesday. That rate is a 12.6% increase from August 2012.

Amid the housing recovery, developers this year have increased construction of new homes, but the pace has yet to return to historically normal levels. Builders cite the lack of suitable building lots and tough access to credit among their concerns.

Builders also said that some buyers had pulled back on new home purchases recently because of higher mortgage interest rates, which have risen more than one percentage point since early May.

Sales of newly constructed homes rose in all regions expect the West, where sales dropped 14.6% from July.

The median sale price for a new home in August was $254,600 nationally and there was a five-month supply of homes for sale at the current sales pace.

(Source: LA Times)

Highest 9K lot value sale in North Santa Monica and Palisades sale 300K over asking

After taking a hiaturs since the housing crash, builders are back in droves looking for potential projects especially in areas like Pacific Palisades and Santa Monica where profits of $800K-$1M can be had in a hot market. The builders are also competing with end users who are sick of trying to find the right house and willing to build. Without much inventory the price for desirable land is skyrocketing and the end user willing to pay a little bit more tends to be winning the majority of these battles.

702 21st Street- Word is an end user won a tenacious multiple offer battle featuring 12 bidders for this Gillette Regent lot. The fixer/tear down property was listed for $2.2M and ended up selling in a cash deal with no contingencies for $2.650M on October 29th. This is the highest recorded price for a 8,900 Gillete Regent lot that was priced to sell for land value. $450K over asking! On the heels of this sale…

702 21st Street- Word is an end user won a tenacious multiple offer battle featuring 12 bidders for this Gillette Regent lot. The fixer/tear down property was listed for $2.2M and ended up selling in a cash deal with no contingencies for $2.650M on October 29th. This is the highest recorded price for a 8,900 Gillete Regent lot that was priced to sell for land value. $450K over asking! On the heels of this sale…

221 18th Street- This charming vintage Spanish boasts 2,000 sq. ft. with 2 bed/2.50 bath on a 8,925 sq. ft. lot. Located on one of the premier streets North of Montana, it also garnered a lot of initial interest with 11 parties initially bidding on the home with a list price of $2.2M. They ended up countering six parties and rumor has it the winning bid was all-cash around $2.4M with a 21 day close.

The Palisades is not far behind…

1342 Charmel Place- Marquez Knolls is not the easiest location to find in the Palisades but it does boast incredible ocean views and a complete escape from the city. This property provides the perfect landscape for a designer/architect to take full advantage of breathtaking views. The 4 bed/3 bath, 2,808 sq. ft. home on a 12,455 sq. ft. lot (only about 7,500 useable) sold for $2.002M, just over $350K above the list price.

Two homes sell $100K over asking on Dewey in Mar Vista!

Check out these two recent sales on Dewey. The Westide is on fire and don’t be surprised if Mar Vista is up over 20% by the end of the year. We have seen a significant jump in the past three months as buyers desperate for properties are doing whatever they can to get a foot in the door…especially for a home in excellent condition.

12673 Dewey St– Being located right next to the Santa Monica Airport didn’t phase buyers looking for a modern architectural that was recently completed. The 1,900 sq. ft. home (2,400 if you include the finished garage that is used for living purposes) received over 6 offers and sold for $1.425M, which is $130K over the list price of $1.295M .According to public records the house sold for $580K in February before being reconstructed in its current condition.

The house had a strong emotional appeal for someone seeking an architectural style home but with only a 5,483 sq. ft. lot the back-yard is tiny and backs up to a public walk-way. The neigbors must be estatic with this sale at $736 a sq. ft and yet another example of how quickly the market has changed.

12114 Dewey St- This custom architectural created quite a buzz. Located in the Mar Vista Elementary school district, young families were clamoring over this 3 bed/3 bath, 2,187 sq. ft. home on a 5,850 sq. ft. lot. Rumor has it they received over 12 offers at the $1.397M list price. The property ended up selling for $1.501M with a 30 day escrow period. This home has a higher quality feel compared to 12673 Dewey and the kitchen and master bedroom areas are more spacious.

12114 Dewey St- This custom architectural created quite a buzz. Located in the Mar Vista Elementary school district, young families were clamoring over this 3 bed/3 bath, 2,187 sq. ft. home on a 5,850 sq. ft. lot. Rumor has it they received over 12 offers at the $1.397M list price. The property ended up selling for $1.501M with a 30 day escrow period. This home has a higher quality feel compared to 12673 Dewey and the kitchen and master bedroom areas are more spacious.