Foreign Buyer Activity Hotter Than Ever

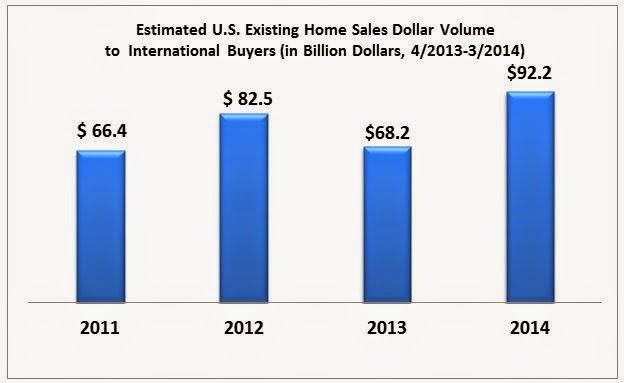

A record amount of foreign money is flowing into the U.S. housing market. And the Southland is a prime destination. Overseas buyers and new immigrants accounted for $92 billion worth of home purchases in the U.S. in the 12 months ended in March. That’s up 35% from the year before, and the most ever.

Nearly one-fourth of those purchases came from Chinese buyers with a 55% increase in total purchase compared to last year. And the place they’re looking most is Southern California. Among U.S. cities, Los Angeles was the top destination for real estate searches from China, San Francisco was second; followed by Irvine.

Some families are buying houses for their children attending California universities, or even high schools in some top districts. Others see the U.S. as a smarter investment than the overheated Chinese housing market.

“These are famous cities they know,” said Liu, an immigrant from China who is a realtor and estimates that half her business now comes from Chinese buyers. “They know San Francisco. They know Los Angeles. They know Irvine.” Good schools certainly help. Liu said many of her clients are families with children, planning to immigrate to the U.S. and looking for a top-ranked school district. And the high-cost Chinese housing market means that even neighborhoods in the U.S. where the median price is pushing $900,000 can look like a steal.

Not just Asians- The weather of Southern California appeals to Europeans; the glamour to buyers from Russia; and the economic stability to Latin Americans looking for a haven.

“The world has really opened its eyes to California,” he said.

Still, he noted, these global elite are only active in a certain slice of the market. And while that may keep driving up prices at the high end, it probably won’t make much difference to the average first-time home-buyer in a middle-class neighborhood.

Still, he noted, these global elite are only active in a certain slice of the market. And while that may keep driving up prices at the high end, it probably won’t make much difference to the average first-time home-buyer in a middle-class neighborhood.

Sources- LA Times/Calculated Risk Blog

Understanding Debt to income ratio…A very important factor when qualifying for a home loan

Since they are so important to a successful mortgage application, here’s a quick overview on what goes into DTIs and why they are such a big red flag. Debt-to-income ratios for home loans are the most direct indication to a bank about whether you are going to be able to afford to repay the money you want to borrow.

Debt ratios for home loans have two components.

The first measures your gross income from all sources before taxes against your proposed monthly housing expenses, including the principal, interest, taxes and insurance that you’d be paying if the lender granted the mortgage you sought.

As a general target, lenders like to see your housing expense ratio come in at no higher than 28% of gross monthly income, though there is flexibility to go higher if other elements of your application are viewed as strong. In May, Freddie Mac and Fannie Mae had a housing expense ratio of 22%. Federal Housing Administration-approved borrowers had average housing expense ratios of 28%.

The second DTI component — the so-called back-end ratio — measures your income against all your recurring monthly debts. These include housing expenses, credit cards, student loans, personal loan payments and others. Under federal “qualified mortgage” standards that took effect in January, your back-end ratio maximum generally is 43%, though again there is wiggle room case by case.

Most lenders making loans eligible for sale to Fannie or Freddie prefer not to see you anywhere close to 43%. In May, according to Ellie Mae, the average approved home purchase applicant had a back-end ratio of 34%. Even at FHA, which tends to be more lenient on credit matters than Fannie or Freddie, the average back-end ratio for buyers was 41%. The average for denied applications was 47%.

A good place to learn more about DTIs and to compute your own is Fannie Mae’s consumer-friendly “know your options” site (www.knowyouroptions.com), which includes calculators and other helpful tools.

Also, most lenders want to see FICO scores well above 700 — Fannie and Freddie averages were in the 755 range in May; FHA average approved scores were a more generous 684.

Bottom line here: If you want to be successful in your mortgage application, be aware of these key turnoff points for lenders and take steps to avoid the tripwires.

(source: Washington Post Writers Group)

Tight Inventory + Silicon Beach = Multiple Offer Hysteria

The strong seller’s market of 2013 is bleeding into the 1st quarter of this year and showing no signs of slowing down, especially with homes priced under $3 million dollars.

With tight inventory, interest rates staying fairly low and an influx of young wealth moving to the Westside (Silicon Beach), the process of buying a home in the area requires quite a bit of patience and understanding it will take a premium number above the comparables to attain a desirable property. It is important that buyers work with local agents that have a good reputation to give them a better shot at acquiring a property.

I have been fortunate enough to close quite a few deals on the behalf of buyers involved in multiple offers the past six months. The feedback from the listing agent’s was the professionalism of our offer package and knowing our team was a good group to work with helped position our client’s favorably with the seller. Price is ultimately the major factor but when the seller has the ability to choose between three or four great offers, the small details make the difference between getting the property of your dreams or not even getting countered.

Here is a look at some individual sales on the Westside illustrating the current market dynamics-

12613 Woodbine- Mar Vista– This major remodel+addition of about 500 sq. ft. immediately went into escrow about $75K over asking at $1.575k. The initial offer was so strong the builder did not want to mess around and accepted without countering other parties. The house is 3 bed/3 bath, 1,750 sq. ft. on a 5,676 sq. ft. lot. The house was completely redone in a superior manner compared to recent flips/remodels recently on the market. The builder did a good job with the attention to detail and will be rewarded handsomely for it. The house will end up selling at $900.00 a sq. ft which is a record for the area. The builder bought the home in March of last year for $835,500. Even with as much as $250K into it, the return on investment is substantial.

12613 Woodbine- Mar Vista– This major remodel+addition of about 500 sq. ft. immediately went into escrow about $75K over asking at $1.575k. The initial offer was so strong the builder did not want to mess around and accepted without countering other parties. The house is 3 bed/3 bath, 1,750 sq. ft. on a 5,676 sq. ft. lot. The house was completely redone in a superior manner compared to recent flips/remodels recently on the market. The builder did a good job with the attention to detail and will be rewarded handsomely for it. The house will end up selling at $900.00 a sq. ft which is a record for the area. The builder bought the home in March of last year for $835,500. Even with as much as $250K into it, the return on investment is substantial.

3216 Federal- Mar Vista- This classic 3+3 at 2,083 sq. ft on close to an 8K lot hit the market in early

February and was under-priced by the listing agent at $1.075M. They received 25 offers and it reportedly is in escrow for $325K over asking at around $1.4M. The house does require some remodeling of the kitchen area and updating of the bathrooms but it does allow for a young family to move in and fix it up over time.

2045 11th Street- Santa Monica- We represented the seller in this transaction and received six offers and

ultimately sold to an all-cash buyer for $1.352M, $53K above the asking price. All of the potential buyers were well qualified and made it very difficult on the seller on which offer to choose after one round of counters. The 2 bed/2 bath, 1,536 sq. ft. home on a 5,800 sq. ft. lot has strong emotional appeal with a recently redone kitchen opening to a great room that is flooded with a ton of natural light. The outdoor deck with spa and the overall private feel of the property contributed to such a high interest level. We had over 200 parties attend the Sunday open and Tuesday broker caravan.

1936 Thayer- Westwood- This 2+2, 1,618 sq. ft. home on a 7,184 sq. ft. lot was listed for $1.295M earlier this week and is reportedly in escrow for above $1.370M. They received 15 offers. This house will need to be remodeled but had a good lay-out and a library that could be converted to a third bedroom. The location is in a great pocket of homes just south of Santa Monica and west of Beverly Glen.

Santa Monica has a strong October- 81% of sales over asking!

After a slow month of closings in September with 18, the pace picked up a bit in October with 22 Single Family Residences being sold. A big difference in the past two months is how many homes sold at or above the list price. In September, only six of the sales were at list or higher while 18 were this month.

The average sales price came in at $1.996M (more closed sales in Ocean and Sunset Park) compared to $2.431M last month. The average days on market was down to 43. It was 56 last month. The average sales price was $3.5% above the list price. Last month it was barely above at 0.5%. The average price per square foot was $962.11.

Please be careful when using price per sq. ft. when analyzing value. The lot size and location must be comparable or price per square footage does not work due to the land values being so high.

Let’s look at a few sales that stood out:

South of Montana dirt goes for $1.8M- 911 22nd street- This 3 bed/2 bath, 1,270 sq. ft. home on an 8K sq. ft. lot, sold for $1.780M, $230K above the list price! This home was sold to a developer/builder and they will either tear it down or perform a major remodel. The bidding for this property was intense with 16+ offers being received by the listing agent. The winning bidder most likely closed all cash with no appraisal and a very short inspection period, if any. Partners Trust represented the buyer. The 90403 zip (between Montana and Wilshire) is really hot with people priced out of 90402 realizing they still get a great location and the same schools. The key is finding homes that are not surrounded by mutli-family buildings.

Ocean Park charmer goes 275k over asking– 1420 Sunset Avenue, located just north of Penmar golf course, is a 4 bed/3 bath house on about a 7K lot. The square footage was not published in the MLS due to some rooms not being permitted but we heard it was 1800+. The property was listed at $1.099M and sold for $1.375M. Despite needing some upgrades (especially kitchen and bathrooms) this home got a lot of attention from young families due to its size and large backyard. They received over 10 offers.

Ocean Park charmer goes 275k over asking– 1420 Sunset Avenue, located just north of Penmar golf course, is a 4 bed/3 bath house on about a 7K lot. The square footage was not published in the MLS due to some rooms not being permitted but we heard it was 1800+. The property was listed at $1.099M and sold for $1.375M. Despite needing some upgrades (especially kitchen and bathrooms) this home got a lot of attention from young families due to its size and large backyard. They received over 10 offers. Tudor on Euclid creates quite a buzz- 418 Euclid Street- This 4 bed/3 bath, 2,688 sq. ft. home on a 7,500 sq. ft. lot sold for $2.815M, $220K over the $2.595M list price. The home featured updated kitchen and baths along with well kept hedging in the front yard allowing the new owner to fully utilize it in a private manner if they like. If a young family bought the home, the private front yard is key with a pool taking up most of the backyard. The seller received seven offers and it closed escrow in about 30 days. Partners Trust represented both the seller and buyer.

Probable remodel/rebuild candidate sells for $2.55M on 21st place- 259 21st Place- This 3 bed/3 bath, 1844 sq. ft. home on a 7,600 sq. ft. lot sold for $155K over the $2.4M list price. The charming home in a fabulous location is in good enough shape to live in for the short term, but will definitely need to remodeled/updated. The seller received over seven offers.

Important answers to frequent questions about maximizing your credit score

Thanks to John Ciolino at First Capital Mortgage (contact: 310-656-8201), here is some key information everybody should know concerning their credit. The better FICO score you have typically means you will be offered a lower interest rate from the bank when applying for a home loan.

1- Is it best to pay off your credit cards in full each month?

No, to maximize FICO score, it is best to leave a small balance.

2- If you have a collection account, is it best to pay it off in full?

No, a paid collection is the same as a collection. A “paid collection” today hurts FICO scores more than an older “collection”. Only pay collection if the creditor agrees to “remove” collection.

3- If I buy new furniture, would my credit be better if I charged it on my Visa or financed through the store with “no interest” until 2017?

“Deferred” debt has a higher default rate and has bigger impact on credit score.

4- Does is it make sense to close old credit card accounts that you are no longer using?

Not necessarily, one of the FICO factors is length of credit.

5- Which is more damaging to credit?

a. 30 day mortgage late on July ’12 on a $1 million dolllar loan or b. 30 day late on Visa June ’13; $64.00 balance?

The more recent debt has a bigger impact on FICO than the amount of debt!

Partners Trust 3rd Quarter Report

The strong momentum of the market for both single family residencies and condos is demonstrated in our latest third quarter report. Some areas see a dramatic increase in price as well as strong reduction in average days on market compared to 2012.

However, as you have read in my recent blog postings the market is starting to “normalize” above the $1.5 million dollar mark in the past month. We still see plenty of multiple offer activity on choice properties due to the lack of inventory especially in choice zip codes.

If you would like more detailed information on a specific zip code or area on the Westside, please shoot me an e-mail at john.skinner@thepartnerstrust.com and we will gladly get the information to you.

Please click the link below:

US homeownership at 1995 levels despite housing rebound- are investors starting to pull back?

The nation’s homeownership rate was 65.1% on a seasonally adjusted level in the third quarter, the Census Bureau reported. Homeownership hasn’t been this low since the last three months of 1995.

The fact that homeownership has fallen during the housing rebound shows investors have been a major force in sending home prices skyrocketing. Individuals and Wall Street players have descended on the housing market, looking for bargains and cash flow. They have scooped up many lower-priced homes to flip or rent out. Last month 33 percent of all existing home sales in the US went to “all-cash” sales, a massive part of the market. Since the typical American doesn’t have much money saved to purchase homes, these are not your typical first-time home buyers.

But now, investors have shown signs of pulling back because higher prices have made their investments less attractive. That has raised questions about whether first-time buyers will step in to fill the void, which experts say is key to a continued recovery.

The homeownership rate peaked, on a seasonally adjusted level, amid the housing boom, at 69.4% in the second quarter of 2004.

(Sources: LA Times and Doctor Housing Bubble)

Fixed mortgage rates move slightly higher- 30-year at 4.16%

A better economic picture sent mortgage interest rates higher this week, with Freddie Mac reporting that a 30-year fixed-rate home loan averaged 4.16%, up from 4.1% last week.

The interest rate for a 15-year fixed mortgage, popular with people refinancing their homes, averaged 3.27%, up from 3.2%.

Freddie Mac polls lenders each Monday through Wednesday about the terms of the loans they are offering to mortgage borrowers with strong credit ratings and 20% down payments or home equity. Borrowers would have paid about 0.75% of the loan amount in lender fees and points to obtain the rates, Freddie said.

(Source: LA Times)

Santa Monica is bracing for a growth spurt

Check out this LA Times article about the future development plans for Santa Monica, especially involving the areas around the new expo rail line which will link the city to Downtown LA. Santa Monica (2016) is poised for more growth and depending on people not using cars as frequently. I sure hope they are correct or the gridlock that is already unbearable in Santa Monica during rush hour will be a true nightmare.

Link: Santa Monica is bracing for a growth spurt

Mar Vista- 68% of sales in September at asking or higher..prices surpass 2006 peak levels

Mar Vista had 25 single family sales in the month of September which is way down from the 43 that sold in September last year, according to the MLS (this does not include off-market activity). The lack of inventory in the area is one of the main reasons for the drop off in sales and increase in sale prices. The average median sale price was $972,500 and the average days on market was 40 with the sale price coming in at 104% of the list price.

Most of Mar Vista has surpassed 2006 peak prices and we are seeing quite a bit of remodeling and building in the area which will lead to increase inventory in 2014 which should slow things down a bit from an appreciation standpoint.

A quick look at a few sales:

Oops- 3717 Ocean View- This 4 bed/3 bath, 3,128 sq. ft. house on a 10,599 sq. ft. lot is a prime example of deceptive marketing and not pricing your home appropriately when listing. The selling agent wants you to believe the house only sold for slightly less than the $1.299M list price at $1.275M. However, a closer look will show the house was on the market for over 328 days with an original list price of $1.699M. In fact, it was originally listed all the way back in 2012 for $2.299M. Other factors may have been in play with this home such as the seller pricing high on purpose while going through a loan modification or frankly just not being a real seller until they had to. That said, the worst way to sell a home especially in a hot market is to unrealistically price it and lose a multiple offer opportunity that will lead to the highest price and favorable contract terms which in some cases can be just as important as the price.

Oops- 3717 Ocean View- This 4 bed/3 bath, 3,128 sq. ft. house on a 10,599 sq. ft. lot is a prime example of deceptive marketing and not pricing your home appropriately when listing. The selling agent wants you to believe the house only sold for slightly less than the $1.299M list price at $1.275M. However, a closer look will show the house was on the market for over 328 days with an original list price of $1.699M. In fact, it was originally listed all the way back in 2012 for $2.299M. Other factors may have been in play with this home such as the seller pricing high on purpose while going through a loan modification or frankly just not being a real seller until they had to. That said, the worst way to sell a home especially in a hot market is to unrealistically price it and lose a multiple offer opportunity that will lead to the highest price and favorable contract terms which in some cases can be just as important as the price.  Multiples on Midvale- 3132 Midvale- This 3 bed/2 bath, 1,664 sq. ft. home on a 5,960 sq. ft. lot created quite a stir when it hit the market in late July. Located just south of National, the house was listed at $869K and immediately garnered multiple offers and sold for $920K with a 45 day escrow period. This traditional home featured remodeled bathrooms, upgraded systems (plumbing, insulation, etc) and a sizable backyard for the area. The home is also located in the Clover Avenue School District…Clover is one of the highest rated LAUSD elementary school’s on the Westside.

Multiples on Midvale- 3132 Midvale- This 3 bed/2 bath, 1,664 sq. ft. home on a 5,960 sq. ft. lot created quite a stir when it hit the market in late July. Located just south of National, the house was listed at $869K and immediately garnered multiple offers and sold for $920K with a 45 day escrow period. This traditional home featured remodeled bathrooms, upgraded systems (plumbing, insulation, etc) and a sizable backyard for the area. The home is also located in the Clover Avenue School District…Clover is one of the highest rated LAUSD elementary school’s on the Westside.  Buyers go nutty for 3480 Wade Street- This 3 bed/2 bath, 1,830 sq. ft. home on a 6,605 sq. ft. lot was listed for $849K and reportedly received over 15 offers and sold for $1.030M. The home was marketed as a fixer/tear down and we have heard a builder had the winning bid. The house is just north of Palms and west of Centinela in a prime Mar Vista location. Two years ago you would not think we would see a fixer/tear down go for over a million dollars this quickly.

Buyers go nutty for 3480 Wade Street- This 3 bed/2 bath, 1,830 sq. ft. home on a 6,605 sq. ft. lot was listed for $849K and reportedly received over 15 offers and sold for $1.030M. The home was marketed as a fixer/tear down and we have heard a builder had the winning bid. The house is just north of Palms and west of Centinela in a prime Mar Vista location. Two years ago you would not think we would see a fixer/tear down go for over a million dollars this quickly.