North Santa Monica Party House Causing Quite the Ruckus

The old Kathryn Grayson Estate on La Mesa Drive overlooking Riviera Country Club was sold in 2010 to a high end designer for $7.7 Million and it has become quite the rave lately…literally. After being extensively remodeled, the owners have tried to think outside the box and have large parties attracting the Los Angeles elite with the goal of trying to get someone drunk enough or high enough to overpay to the tune of $20-25 Million Dollars for the home. The parties have been happening on a frequent basis attracting in upwards of 400 people and driving neighbors on the normally quiet street nuts. Reports of naked people sleeping in cars and open drug use on the street have been circulating around town.

Tonight at the Santa Monica City Council meeting, an emergency ordinance that prohibits homeowners from hosting more than 150 people at one time for the purposes of selling a home. Please see the article below for more detailed information. The attorney representing the owners is threatening a lawsuit against the city if the ordinance is passed…I just have one question: Do the owners realize who the neighbors are that they are driving crazy? Growing up in the neighborhood my answer would be they are not the type of people you want to make enemies with…you may win a small battle but in the long run you will lose the war…in a big way.

UPDATE: The Santa Monica City Council had a split vote on the emergency ordinance and will be revisiting this situation at the next meeting.

Article: North Santa Monica Party House

3rd Quarter Market Stats…Upward Momentum Continues

For the past few weeks I have heard seasoned real estate professionals state they have never seen a market like this. The recovery in home values on the Westside this year has been dramatic and doesn’t show any signs of slowing down. This is a real life case of Econ 101 with lack of supply+high demand equaling upward price movement.

Most of the U.S. is seeing a strong rebound this year but high-end areas butting up against the coast like Santa Monica and Pacific Palisades are getting an even stronger kick thanks to Santa Monica, Venice and the Marina being commercially robust due to major technology companies flocking to the area thus giving it the nickname Silicon Beach.

Please click on the link below and have access to the Partners Trust single family and condo reports where we compare this year’s 3rd quarter to last year’s 3rd quarter. The comprehensive report stretches all the way out to the valley and some eastside locales. Besides strong increases in the average price sold the number you really want to pay attention to is how the average month of supply of inventory has decreased dramatically. The lack of inventory is bordering on historic levels.

North Santa Monica is seeing 2007 prices with moderately sized nice homes going for over $1,000/1,150 a square foot. Santa Monica in general is up 28.67% with the monthly inventory dropping 57.75%…Pacific Palisades is up 26.72% with monthly inventory dropping 30.14%. More moderately priced locales like Mar Vista are up around 10% and seeing montly inventory dropping alomost 60%. Please remember these numbers are only comparing specific quarters and can be skewed a bit.

Please check out:

| http://www.thepartnerstrust.com/market-stats |

Even the bubble bloggers acknowledge market strength

From the Santa Monica Distress Monitor: “I started this blog over 5 years ago. A lot has happened over the past 5 years but I am increasingly convinced that this blog and “bubble blogs” as a whole are largely irrelevant now. Yes there is still “uncertainty”, but there always is. The recovery may be choppy at times but I think it is pretty obvious that we are well into recovery territory. At this rate I won’t be surprised to see quality Westside properties at or very near all time highs over the next year or two. Real estate is boring now, and that’s a good thing. But it also means less blogging. I’m not ready to pull the plug just yet, but from now through the end of the year I anticipate less posting.

Source: SM Distress Monitor

Two significant articles from a national perspective

Article: U.S.families’ debt loads decline to pre-recession levels

Overall, households today are paying less than 16% of after-tax income to cover debt payments and lease obligations, the smallest share since 1984, Federal Reserve data show.

September existing-home sales fell slightly from the previous month, but remain well above year-ago levels as prices continue to escalate on new demand in key real estate markets.

September numbers are up 11% from the 4.28 million units sold a year ago.

**Articles both from LA Times

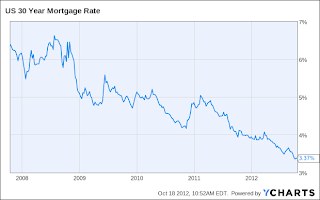

Mortgage rates hovering near all-time lows

Mortgage rates hovered near their all-time lows this week, with the average 30-year fixed loan at 3.37%, down from 3.39% last week, Freddie Mac said in its latest survey of what lenders are offering to solid borrowers.

The record low of 3.36% was set two weeks ago.

Freddie said the average offering rate for a 15-year home loan was 2.66%, a new record low. Borrowers would have paid an average 0.7% of the loan amount in upfront lender fees and points for the 30-year loan and 0.6% for the 15-year mortgage.

Source (article and chart): LA Times

Westside Market Stats

One of the many things I love about Partners Trust is the market research provided to agents and our clients. We have a market research team who know the micro markets that make-up the Westside better than anyone. Click the link below for our latest quarterly market stats for single family homes and condos. Across the board we have seen healthy price increases through 2012. If you would like specific information about a zip code or area, please feel to contact me and we can make it happen!

Mortgage rates rise for third straight week

Fixed mortgage rates rose for the third straight week after setting all-time lows, with the typical 30-year rate on a loan below $417K increasing from 3.59% to 3.62%.

The yield on the benchmark 10-year Treasury note closed at 1.8% Wednesday after bottoming out at 1.4% on July 24. The average 30-year fixed mortgage rate, hit an all-time low of 3.49% that same week. These rates are based on loans to solid borrowers who have 20% or higher downpayments or 20% equity in their homes if they are refinancing. Borrowers typically paid 0.6% of the loan amount in lender fees and discount points.

Source: LA Times

Sale price above list price?! Such is the case for Mar Vista in July

July 2012: # of sales: 38 DOM 20, SP vs. OLP 100.87%/ SP vs. LP 101.07% SP: 874K

July 2010: # of sales: 30 DOM 32 SP vs. OLP 97.11%/ SP vs. LP 99.37% SP: 844K

(Abbreviation key: DOM= Days on Market; SP vs. OLP= sales price versus the original list price. This calculates the sale price from the beginning it hit the market even if a new agent takes on the listing or it was in escrow for a period of time.; SP vs. LP= sales price versus list price at the time of the sale.)

The Skinny: 24 of the 38 sales sold for at or over the original list price with most of those 24 sales receiving at least 3 offers. Even though the numbers in terms of sales price vs. list price and DOM in Mar Vista were strong in July 2010, this past months activity was quite a bit stronger. An average of only 20 days on the market coupled with a sales price above the list price shows the strong demand for homes in this quiet community bordered by Venice, Santa Monica and Culver City. Mar Vista has developed a strong niche on the Westside with young families seeking a home with a more palatable entry price point than Santa Monica/Palisades while still having solid elementary schools (Beethoven, Mar Vista and Clover).

|

| 3534 Mountain View |

3534 Mountain View Ave, a 3 bed/2 bath, 1,604 sq. ft. home sold for 15% above the list price at $1.135M. 3565 Colonial Ave, a 5 bed/4 bath on 3,642 sq. ft. home also sold for 15% above the list price at $1.375M. Colonial was a short sale and in 2004 was purchased for $1.5oM.

Market trends of the week and random noteworthy thoughts

Trending: Multiple offers in all price points from $500,000 up to $5,000,000 is the reality of the moment. And yet, as wonderful as that sounds, proper pricing is critical to achieving robust interest in any home. We are not in a market climate that can absorb overpricing. Bottom line: Buyers need to be pre-approved for loans because you are competing with “all cash” offers and Sellers need to be sensitive to recent comparable sales to create the optimal pricing strategy.

Million dollar home sales continue to climb statewide: According to an article in the LA Times last week, Million-dollar-or-more home sales statewide surged in the second quarter to the highest level since the third quarter of 2007 as the economy and mortgage availability improved. The 7,763 homes sold at $1 million or more from April to June represented an 18.5% increase from the same period last year. It was the most sales in this price range for a quarter since 2007, when 10,946 closings were recorded. Though this is good news, we are still at less than half of the highest quarter number of sales for $1-million or up houses which was the third quarter of 2005, when 15,898 homes changed hands.

Be weary of what you read on the internet: I monitor many real estate blogs, especially those that have been bearish about Westside real estate over the past eight years. They provided good information that I could pass along to my readers, especially from 2005-2010, but many of them have either stopped posting or are providing erroneous information to try and prove the market is unhealthy. As late as last month one site tried to claim the 90402 zip code is down over 20% compared to last year when in actuality it is up around 10%. On the end of the spectrum, I appreciate sites like the Santa Monica Distress Monitor who started off writing about inflated real estate prices but has adjusted with the market and gives a balanced look at the market.

Information from a great realtor is key: Some people are weary of hearing information from realtors thinking it will be jaded and that is understandable as some in this business do not have great ethics, but you are far better off finding a trustworthy professional who provides real time info so you can make the right decision. The media is usually a few months behind what is going on and that difference can cost you tens of thousands of dollars and/or missing out on a wonderful home.