Skinny On Real Estate

Santa Monica City Council restricts new construction to 45% – Creating potential unintended consequences

The Santa Monica City Council adopted regulations that aim to limit the size of the city’s single-family neighborhoods even though a majority of residents say the new rules will prevent them from renovating their homes to accommodate growing families. The new regulation will restrict the size of new construction to 45%, about a 35% restriction compared to the original 61% baseline. In a bit of good news for those with second story homes, the City Council did allow for homes to be remodeled up to 55% (includes garage space). The revisions will be in place beginning January 1st.

The Santa Monica City Council adopted regulations that aim to limit the size of the city’s single-family neighborhoods even though a majority of residents say the new rules will prevent them from renovating their homes to accommodate growing families. The new regulation will restrict the size of new construction to 45%, about a 35% restriction compared to the original 61% baseline. In a bit of good news for those with second story homes, the City Council did allow for homes to be remodeled up to 55% (includes garage space). The revisions will be in place beginning January 1st.

City Hall has spent a year and a half reworking the rules on building height and size that apply to the Sunset Park, North of Montana and North of Wilshire neighborhoods, as well as a small portion of the Pico neighborhood, after residents complained that they were being boxed in by the large houses being built around them — or by two-story homes erecting an additional two-story Accessory Dwelling Unit (ADU).

The issue of lot cover

age was complicated by the ADU issue as California lawmakers recently approved a set of bills that allow property owners to build larger ADU’s (up to 1,200 sq. ft.) as well as a junior ADU’s without it counting against the lot coverage standard. Local and state lawmakers have heralded ADU’s as a way to address California’s housing crisis.

Unfortunately, neither the planning commission nor the City Council sought the advice of local real estate professionals, developers and architects when making such a drastic decision. Some on the City Council were extremely concerned/paranoid that developers would build a large home and then consume the whole backyard with more structures. What they fail to understand is the majority of buyers for new construction single-family homes are growing families with young children that value yard space over building secondary structures. The 45% restriction along with building height and set-back restrictions, will make it very difficult to accommodate a second-level home that can house bedrooms all on the same level per the testimony of architects. This could end up pushing some families away from Santa Monica. A simple adjustment to 50% or 55% would have made things a lot easier from a build-ability standpoint while also accomplishing more appealing looking homes.

Furthermore, the only way to make up for more s”saleable” square footage is to either add very expensive basements or the much cheaper alternative, which is an ADU. The ADU’s would be maximized, and frankly, many will build two-story ADU’s to maximize saleable square footage, thus you will now have properties appearing as duplexes…which will look even more cumbersome/ugly then the homes that created complaints. A two-story ADU will further limit privacy as they would look down directly into backyard space. This will be the unintended consequence of the city council’s decision.

It will not be surprising if upset property owners try to make this a ballot initiative or those in the north of Montana neighborhood approach the city with a plan to create their own set of guidelines.

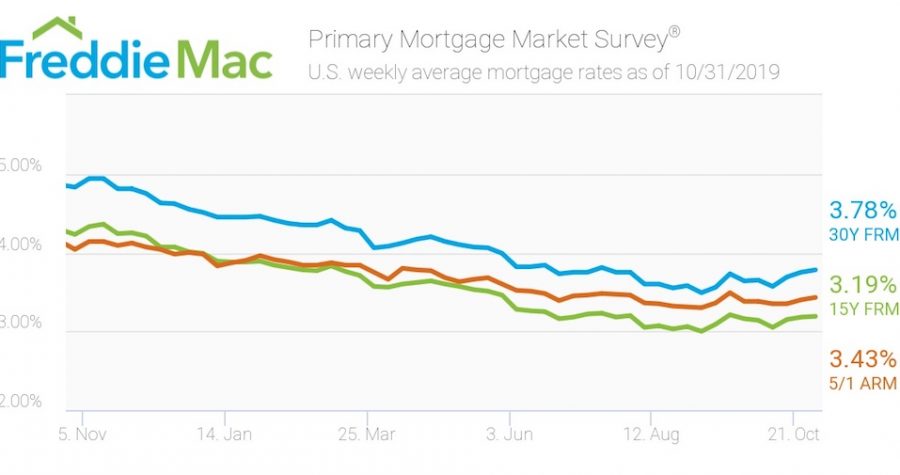

Mortgage rates rise for the third consecutive week

The average U.S. fixed rate for a 30-year mortgage rose to 3.78%. That’s 3 basis points above last week’s 3.75% but still more than a percentage point below the 4.83% at this time last year. This marks the third consecutive week of rate increases, which hasn’t happened since April.

The 15-year Fixed rate morgate (FRM) averaged 3.19% this week, crawling forward from last week’s 3.18%. This time last year, the 15-year FRM came in at 4.23%. The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.43%, ticking up from last week’s rate of 3.4% That being said, the percentage still sits well below 2018’s rate of 4.04%.

Source- Housing Wire

2019 has been a slower year for LA’s luxury market ($5M and above)

Despite a hot LA economy and near record low interest rates, the luxury real estate market in greater Los Angeles ($5M+) has slowed down since last year with overall sales volume down and the days on market for homes actively on the market continuing to climb. As of August, there were 339 sales of $5 million or more in the L.A. area this year compared with 402 sales at the same time last year, according to the Multiple Listing Service.

The trend continues at higher price points but the gap is not nearly as big. There have been 12 sales of $30 million or more this year compared with 13 last year.

Although many speculate about an increase of foreign buyers in the luxury real estate scene, the data show otherwise. Of the 24 home sales of $20 million or more this year, 15 of the buyers were American. The only other countries with more than one buyer were Saudi Arabia and China, which each had two.

Another issue factoring into the decline in luxury sales is the inability to write off property taxes above $10,000 under the recent tax law changes. It has had an adverse impact on the “trade-up” market in which would-be buyers of some $5M+ homes do not want to take on the tax hit, especially if they have been in their current home for a long period of time and paying taxes on a lower property value. Remodeling their current home to fit their needs becomes a more palatable option.

Los Angeles Market Summary and Compass in-depth 3rd quarter market report

Buyers bounced back in the third quarter from being cautious in the first half of the year. The overall number of home sales was only 2 percent below last year, compared to about a 14 percent decline seen in the first quarter.

The improvement in home sales activity was most driven by solid increases in West San Fernando Valley, though other areas saw more sales as well. Still, Eastside communities, which entered the year outperforming their Westside counterparts, saw relatively more slowing in the third quarter. Interestingly, changes to home sales activity varied a lot in this quarter and across regions. Sales of homes in higher priced communities also showed strength in this quarter, particularly areas around Bel Air and Brentwood, as well as Beach Communities to the south.

Home prices generally continued to remain flat compared to last year.

Buyers do seem to be motivated by the lower mortgage rates that characterized the latter quarter of this year, especially given the swift increases seen at the end of 2018 which stopped buyers in their tracks. With mortgage rates expected to remain low and possibly go lower, and more balanced dynamics between buyers and sellers, we are expecting the last quarter of 2019 to post stronger numbers compared to last year. More inventory to choose from has also been a welcome reversal from the severely undersupplied housing market that we saw last year.

Lastly, while economic expansion started to slow and fewer jobs will be added to the labor market, consumers should remember that current housing conditions remain particularly favorable. Buyers of homes in the recent decade have paid much larger down payments than during the last housing boom. Consumers are notably less leveraged as well, while financial institutions have put significant checks in place to keep them well-capitalized. At the same time, the levels of new construction seen in the last decade is still 50 percent and more below the levels seen during the last boom. Together, the current housing scenario is much better prepared to weather slowing economic growth than was the case the last time around.

Here is a link to download the full report

Last-minute policy tweak could hand Airbnb a key victory in LA

The L.A. City Council could consider an ordinance amendment by council member Mitch O’Farrell to allow home-sharing at owner-occupied homes that are rent-stabilized. ‘

The current ordinance, issues a blanket ban on home shares on rent-stabilized units, which make up the bulk of L.A. apartments built before Oct. 1, 1978. There are about 600,000 such units in the city.

The measure, which passed the city’s planning committee last week without opposition, could be a boon to Airbnb and other competitors in the short-term rental space, businesses that have spent the past four years wrestling with Mayor Eric Garcetti and council members over regulation facing their industry. The ban on rent-stabilized units for short-term stays stemmed from concerns about the city’s lack of affordable housing stock, an issue that has gripped L.A. politics during the Garcetti administration.

Council members moved for the ban last fall, arguing that leasing rent-controlled apartments should be for long-term tenants, instead of short-term guests. O’Farrell moved to undo the ban because the council member’s East Side district is one of several L.A. districts that contains a “high density of older housing stock,” said O’Farrell’s policy director Christine Peters, including myriad “cute, little Spanish duplexes.”

Owner-occupied units engaging in short-term rentals is a natural fit for L.A, Peters said, because there are a lot of entertainment industry workers who can leave on projects for consecutive weeks – enough time to rent out their homes for short-term stays, but not enough for long-term tenants.

Peters noted that the amendment does not allow multifamily landlords at rent-stabilized dwellings to engage in short-term rentals, unless it is their primary residence. It also does not let renters to do so, though Peters said the council member may seek to amend the ordinance at a later date. Affordable housing proponents have not yet spoken out against the O’Farrell amendment.

Source- info pulled from Real Deal

RED ALERT- Santa Monica looking to severely restrict single-family homes

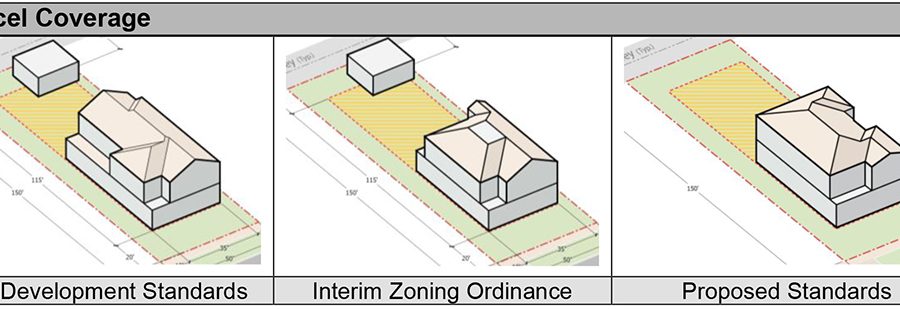

On October 22nd, the Santa Monica city council will possibly finalize regulations that seek to further restrict a homeowners ability to remodel or build a new home. After initiating an interim zoning ordinance of a maximum lot coverage of 55%, the city is looking to further restrict the lot coverage to 45% for two-story homes, making it one of the most restrictive in Southern California. Some City planning officials are concerned the city is moving way too quickly with these proposed regulations and are STRONGLY ENCOURAGING residents to voice their opinions at the October 22nd City council meeting at 6:30pm and by e-mailing your thoughts to councilmtgitems@smgov.net with the subject line- R1 Update.

The lot coverage used to be 61%, so a drop to 45% would signify over a 35% reduction for two-story homes and when you account for an attached garage, it drops even further. The City of Santa Monica calculates square footage including outside walls and the full size of an attached garage. The City of Los Angeles measures inside the walls and only counts 1/2 of the garage space. Currently, the Pacific Palisades has 65%, Mar Vista has between 50-60% based on lot size, Venice has 55% and Brentwood is at 45%.

The city has spent the year considering how to incentivize renovating homes rather than replacing them in the city’s four single-family neighborhoods — Sunset Park, North of Montana, North of Wilshire and a small part of Pico.Unfortunately, in trying to inhibit builders from building “McMansions”, the chosen path “over-corrects” the issue and severely inhibits those with inherited floor-plan flaws (i.e.- lone master upstairs), especially those with lots less than 6,000 sq. ft.

Despite input from property owners stating they were comfortable with 55% lot coverage, the city planning commission recommended further reductions. New one-story homes would cover 50% of the lot and new two-story homes would cover 45%. Homeowners remodeling their existing one-story home could cover up to 55% of their lot but those with a second story would be out of luck.

Upper-story maximum parcel coverage of 22.5% is also being proposed. It is currently 30%. The new restriction would make it extremely difficult on people who own homes on smaller lots to have adequate bedroom spaces on an upper level.

The standards would also encourage accessory dwelling units, or ADUs, which homeowners build in their backyards and rent out. The state of California is mandating this to help address the housing crisis. Interestingly, property owners who already have homes at the 61% maximum, would be able to build ADU’S, thus covering over 70% of the lot. Thus creating an even bigger gap between those who already have bigger homes and those who do not. IF YOU ARE A SANTA MONICA PROPERTY OWNER, MAKE SURE YOUR VOICE IS HEARD.

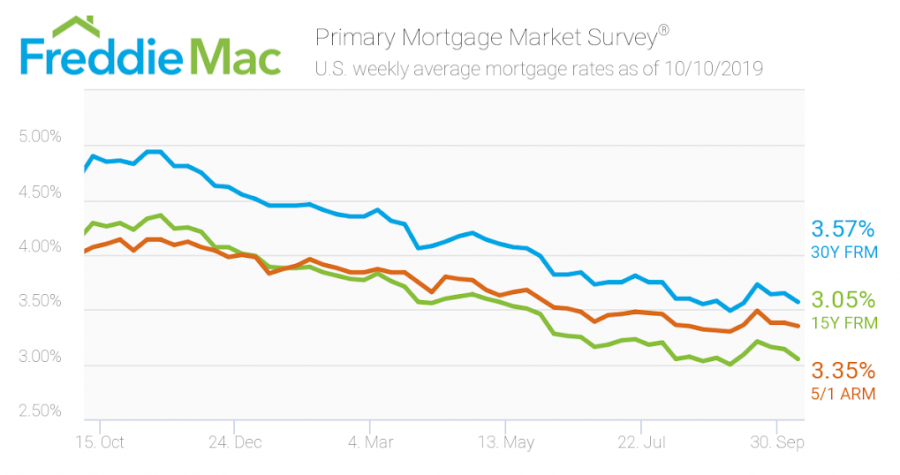

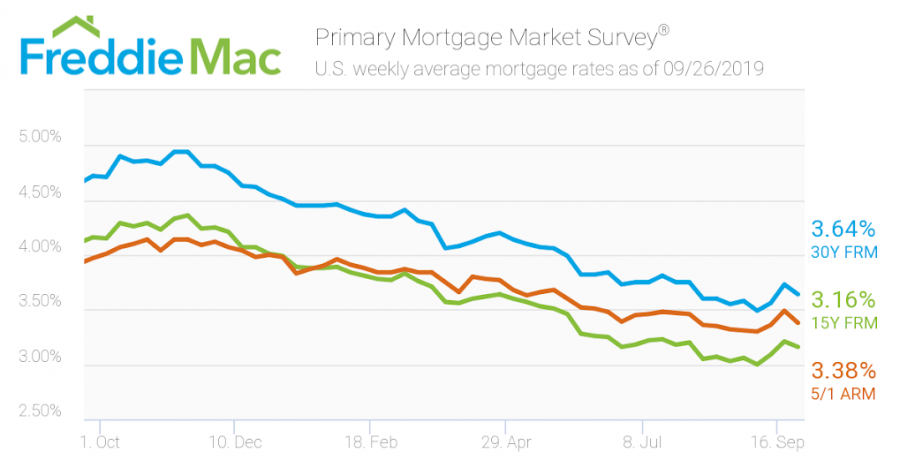

Mortgage rates fall yet again

The 30-year fixed-rate mortgage averaged 3.57% during the week ending Oct. 10, down 8 basis point from the previous week. This is a stark change from a year ago when the 30-year fixed-rate mortgage averaged 4.90%

The 15-year fixed-rate mortgage dipped 9 basis points to an average of 3.05%, according to Freddie Mac. The 5/1 adjustable-rate mortgage averaged 3.35%, down 3 basis points from a week ago.

Mortgage rates roughly track the direction of the 10-year Treasury note, the yield of which has fallen by more than 10 basis points over the last month and roughly 100 basis points throughout 2019. Falling mortgage rates have yet again caused a resurgence in refinancing activity. The most recent mortgage application data from the Mortgage Bankers Association showed that refinance activity was 163% higher than a year ago. The same trend has not occurred when it comes to loans used to buy a home. Purchase loan volume was only up 10% from a year ago, the Mortgage Bankers Association reported.

Source: Marketwatch

Home prices soared 60% over 5 years in some parts of LA – Inglewood leading the way

|

| Inglewood Stadium Rendering |

A surge in in commercial development, the Westside’s tech industry growth, major international investment and a seven-year run of very low interest rates have led to a significant rise in median sale prices over the past five years.

The median sale price in Inglewood climbed 63% from the high $200K range in 2014 to $485K last year, according to PropertyShark. Inglewood is seeing a massive surge in investment thanks to the 300-acre L.A. stadium and Entertainment district that will house the Rams and Chargers beginning next year and the Clippers franchise proposing a new stadium.

Culver City saw the second biggest increase in median prices at 60% from $800K to $1.2M. All but three of the 67 markets PropertyShark analyzed in Southern California saw the price of homes grow and half of those appreciated more than 20%.

Source: The Real Deal

Los Angeles Rent Rankings – Westwood is the priciest ranking 4th nationally

For the second straight year, Westwood ranks as the most expensive place to rent an apartment in California with an average rent payment of $4,944.00 a month. It is a 4.1% jump compared to last year. Westwood ranks 4th nationally behind three areas in Manhattan, New York. West Hollywood’s 90048 zip, comes in 2nd at $4,896 and 5th nationally.

Here are other Westside locations that ranked in the top 50 nationally-

Culver City $3,881.00- 26th

Marina Del Rey- $3,804.00- 41st

Santa Monica- $3,787.00- 43rd

Playa Vista- $3,735.00- 45th

Source- Rentcafe.com